Technology from Harrod's Creek

Stephen E. Arnold

June, 2003

Search Marketing: The New Internet Gold Rush

Jupiter Research, a division of Jupiter Media, recently announced that that it was creating a new advisory service to help companies "choose partners and products that take advantage of changes in the search industry."

The new service will complement other services, including Danny Sullivan's successful Search Engine Strategies' conferences. These global seminars fill cavernous meeting rooms with rapt marketers. The attendees pay handsomely to learn how to use the Internet user's thirst for search-and-retrieval to drive traffic to a specific Web site. At stake, of course, is money. Very big money. A site with no traffic is difficult to justify. The Web marketers in the audience are also thinking about their job security. High traffic often translates to a happy employer.

The changes in the search industry are significant. Search engines have become a synonym for pay-for-placement direct marketing.

Search Marketing Defined

Jupiter said that it would track "Search Marketing". Search marketing is the term used to describe an advertiser's buying words on a search engine. When a user enters a query for hotel reservations on Ask Jeeves (UK) or Google (UK) for example, Web sites or text advertisements appear in the list of "hits." Some sites make the advertisements separate. Google uses text-only messages adjacent a list of results. Microsoft's MSN makes a user scrutinize the listings to find those that are not paid listings. Every search engine takes a different approach. But one thing unites them-selling traffic is big business because it works.

The driver for Jupiter's new service is, according to the company, is findings in a recent Jupiter survey that search engine marketing is "fast trumping banner advertisements among some marketers." The survey found that 76 percent of marketing executives who use search engines to market say that buying clicks is more successful than banner advertisements. Jupiter says that the study revealed that 64 percent of the marketing executives in the sample plan to increase their spending on search strategies.

Jupiter is not alone in its enthusiastic embrace of search marketing. Yahoo is rumored to be preparing its own pay-for-traffic program that includes options for placing advertisements in electronic mail messages among Yahoo Groups' members based on the content of the message and the topic of the Yahoo Group.

What has emerged from the dust of the Dot Com collapse is a revenue model that makes advertisers, company executives, and investors shiver with some of the old Dot Com boom anticipation of untold riches. Not surprisingly, a new Internet gold rush has started. The basic concept is getting advertisers' listings to the top of search results on the keywords relevant to the advertisers' businesses.

In the U.K., Ask Jeeves said that it was dropping eSpotting for Google. Google, of course, is a newcomer to search marketing, but already its influence is exerting a gravitational effect not only on Jupiter Media but on advertisers who want access to the U.K. traffic.

With the Ask Jeeves' deal, Google may be poised to provide advertisers with access to as much as two-thirds of the U.K. search traffic, according Bambi Francisco, CBS.MarketWatch.com.

But there's more than Web page retrieval to the reinvention of search. Dealtime acquired Epinions.com. Before the ink on the contract was dry, Dealtime said that the union of the two companies created a new category of search. Dealtime calls it Search Shopping.

The rush is on. Search is being applied to everything from customer service to Web sites. Even with the intense activity, there are huge domains of content that remain to be brought into the advertiser model. These untapped content domains are on the radar of Google and others in the field. Pyra Labs is known for its Blogger.com site and allows any one to become a reporter and news service.

The Gold Rush 2003?

According to Dan Ballister, a senior executive at FindWhat.com, one of the Big Four search marketing firms in the U.S. "Brand advertisers and their agencies know that search marketing can help them hit reach and frequency goals in a very precise way, and direct marketers have discovered that search marketing offers them the most targeted, qualified, cost-effective traffic online that converts into customers. Search marketing, especially in the U.S. and Europe, is rapidly gaining a larger share of online advertising budgets because it's the highest-quality traffic and with so many success stories out there, the word is getting out."

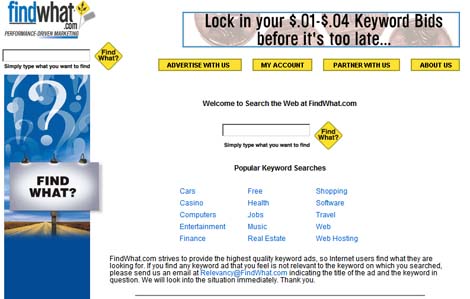

FindWhat.com is a leading developer and provider of performance-based marketing services for the Internet. They distribute advertisements, based on keywords, throughout their network of hundreds of high traffic distribution partners, including search engines such as: CNET's Search.com, Excite, Web crawler, NBCi, MetaCrawler, Dogpile, and Go2Net. Advertisers determine what price they're willing to pay for each targeted click-through, and they only pay when a prospect clicks on their advertisement. This is what search marketers call the "pay-for-performance model." Advertisers pay for clicks, not the promise of clicks. FindWhat and others providing this service offers marketers' exposure through the millions of advertisements distributed throughout their network each day.

Search marketing is not a U.S. or European phenomenon. According to Mr. Ballister, "The foundation of search marketing is a global force much larger than the Internet. The key driver here is the never-ending need for companies to continually acquire customers in a cost-effective way. Search marketing will provide those same advantages in Asia."

What is happening is a diffusion of information, information once known only to a coterie of Internet savvy marketers. Today a multi-channel marketer knows that testing new channels is the key to finding the right formula for marketing success. The opportunity to make data-driven decisions is very strong online given our ability to measure core metrics like reach and conversions, and marketers are using this data not only to improve their online marketing, but also to improve their off-line efforts as well.

FindWhat has shown strong interest and active exploration in the market,. Watch for FindWhat to enter the European market in the near future. With that entry, FindWhat will bring its network of over 225 distribution partners, which sends interested searchers to 25,000+ advertisers, offering a solid revenue stream for our affiliates, and a steady flow of qualified, highly targeted customers for our advertisers. With over 1 billion searches happening within our network each month, we can have a very significant and positive impact for our partners.

Hitting the Market's Sweet Spot

FindWhat is focused largely on affiliates in the middle market of medium-sized sites, and it provides an opportunity for our advertiser base to reach a broader set of potential customers in a very cost-effective way.

But Overture and Google also offer a "pay-only-for-clicks" program as well. How does Find What differ from the rapidly expanding Google and industry front-runner Overture?

Says Mr. Ballister, "FindWhat is different from Overture and Google in two ways. FindWhat has a middle-market distribution focus. The result is that FindWhat offers advertisers a way to reach a large group of searchers who are likely to be missed in other programs. Those looking for traffic will also find FindWhat's bid prices somewhat lower as well."

The key, according to Mr. Ballister, is that "a FindWhat advertiser only pays for the actual traffic received with much of that traffic coming from sites that attract an otherwise hard-to-reach user base. Advertisers are flocking to the search marketing space because there is no fear of accountability in this space. He says, "At FindWhat, we work very hard to send only the most qualified traffic to our advertisers, and these advertisers pay only for the users that choose to visit them. In addition, our average bid prices are much more affordable than other pay-per-click options, which leads to lower customer acquisition costs for FindWhat advertisers." It makes sense that larger portion of online ad budgets are being diverted to search marketing.

Mr. Ballister says, "FindWhat is now exploring additional options for its customers like geotargeting, time-of-day/time-of-week targeting."

Although consolidation seems likely, Mr. Ballister notes, "The search marketing space is very deep. It is almost as diverse as the e-mail marketing sector. In fact, search is the second most popular online activity after e-mail. Marketing dollars always follow the eyeballs. So, over time, niches will get created, technologies will evolve, new partnerships will be formed, and the search market will continue to grow."

He continues, "Mature industries such as aviation have smaller companies, like RyanAir in Europe and JetBlue in the U.S., that find smart ways to compete very effectively. I think we'll see the same thing in the search marketing space as it continues to expand."

FindWhat gives its advertisers have 24/7 access to their campaigns via a user-friendly, password protected interface. Mr. Ballister adds, "FindWhat was the first-to-market with an analytics tool called AdAnalyzer, which allows our advertisers to measure ROI on a per-keyword basis. Also, every advertiser has an Account Manager who watches over their account, and we're in regular contact with many of our advertisers to help them manage and improve the performance of their ad campaigns. Of FindWhat's 120 employees half are involved in direct contact with customers."

The technology behind FindWhat is a Windows-based, SQL server platform, with a proprietary bidding system designed by the firm's chief technology officer, Tony Garcia, and his engineering team. FindWhat delivers about 35 million searches per day, about one-third of Overture's volume.

Is search marketing for those with deep pockets? "No," says Mr. Ballister, "We recommends that newer advertisers allocate sufficient money to create a 90-day online presence. A three month program gives an advertiser enough data to optimize, and then expand the campaign. Normally, those budgets can be less than $1000, but budgets for search marketing grow quickly when advertisers see results."

Advertiser Tools Important

FindWhat's concept took form in the mid 1990s. The chief executive officer, Craig Pisaris-Henderson, recognized the coming opportunity for a performance-based, direct marketing tool that could leverage the natural targeting functionality of the Internet, specifically search. Tony Garcia, the chief technical officer, built the FindWhat bidding engine. 25,000 advertisers later, that basic process is working better than ever.

FindWhat customers have access to an Advertiser Solutions team. Mr. Ballister says, "FindWhat launched several tools in recent weeks to help our clients manage their campaigns-AutoBid helps clients program their bid prices while simultaneously reducing bid gaps whenever possible. The Campaign Scheduler provides automated turn on-turn off functionality for advertisers who sometimes need temporary downtime for system upgrades or out-of-stock situations. We keyword suggestion tool in our Keyword Center, and many advertisers work directly with our Account Manager team to help identify other keywords they may have overlooked."

Rapid Innovation, More Competition Coming

New search marketing services are now appearing frequently. A recent example is Turbo10.com. This service focuses on the "Deep Web" or those hard-to-find pages that many search engines do not index. Turbo10's marketing innovation is that in addition to low fees the advertisements go live immediately. Overture, for example, inserts an editorial step into its system. Turbo10 states on its Web site, an advertiser's that "listings will appear in the Turbo10 Search Results immediately after you register. Open an account for as little as £25.00 GBP. That is equal to approximately $37.00 US Dollars. Bids begin at £0.03." That's about one-third of Overture's lowest cost word and lower in price than many search engine marketing fees. FindWhat offers works as low as $0.01.

Turbo10's marketing collateral fires a shot across the bow of the industry leaders. Says Turbo10, "Traditional crawler-based search engines like Yahoo and Google can only index static Web pages - the 'Surface Web.' But the Surface Web represents only a small percentage of the available information on the Internet (CNN). A wealth of high quality information lies behind thousands of smaller, topic-specific search engines. These search engines are inaccessible to traditional crawler-based engines like Yahoo and Google. This vast ocean of mostly untapped information has been called the 'invisible web', 'dark web' or as we call it: the Deep Net."

Gone are the days of objective search results for free. Here are search results for which an advertiser pays. After months of Internet gloom and doom, the fervor over search is a refreshing positive development in a beleaguered Internet arena. Surprisingly few objections to the pay-for-placement trend in search.

In addition, the financial lift for search marketing seems unlimited. As potent as these services are, none has tapped the exploding interest in user-generated content. No, not Web pages, but the murky, fluid world of blogs is not easily reached by advertisers. The information flowing within Yahoo groups is only now being tapped with Yahoo's inclusion of advertisements within postings sent to other members of groups. Will the proliferation of search marketing firms flood the market and lead to an oversupply of promises and an undersupply of results?

"More new services are going to appear," says Mr. Ballister. What's clear is that the surge of interest in search is following the money. Search marketing is growing at a rate of 30 to 40 percent per year. Revenue estimates for U.S. companies is likely to reach $2 billion in 2003. According to Mr. Ballister, 20 percent of Yahoo's revenue is coming from its search marketing partnerships.

With revenue flowing from search marketing, the end of the rainbow may be for the next year the pay-for-clicks bandwagon. Advertisers, it seems, have little choice but jump on board.

Web sites:

Cut lines for captions.

FindWhat offers Web surfers a search service. Results from the FindWhat advertisers are displayed. A query for "search retrieval" displayed a listing for the Onix engine.

Advertisers are able to control the their marketing campaign via a point-and-click tool. Each word selected for a campaign is displayed along with the cost per click for that word. The advertiser can enter bid amounts manually or use an automatic bidding process.

[ Top ] [ AIT Home ] [ Beargrass ] [ Site Map ]