Slopity Slopity Slop: Nice Work AI Leaders

October 8, 2025

Remember that article about academic and scientific publishers using AI to churn out pseudoscience and crap papers? Or how about that story relating to authors’ works being stolen to train AI algorithms? Did I mention they were stealing art too?

Techdirt literally has the dirt on AI creating more slop: “AI Slop Startup To Flood The Internet With Thousands Of AI Slop Podcasts, Calls Critics Of AI Slop ‘Luddites’.” AI is a helpful tool. It’s great to assist with mundane things of life or improve workflows. Automation, however, has become the newest sensation. Big Tech bigwigs and other corporate giants are using it to line their purses, while making lives worse for others.

Note this outstanding example of a startup that appears to be interested in slop:

“Case in point: a new startup named Inception Point AI is preparing to flood the internet with a thousands upon thousands of LLM-generated podcasts hosted by fake experts and influencers. The podcasts cost the startup a dollar or so to make, so even if just a few dozen folks subscribe they hope to break even…”

They’ll make the episodes for less than a dollar. Podcasting is already a saturated market, but Point AI plans to flush it with garbage. They don’t care about the ethics. It’s going to be the Temu of podcasts. It would be great if people would flock to true human-made stuff, but they probably won’t.

Another reason we’re in a knowledge swamp with crocodiles.

Whitney Grace, October 9, 2025

Google Gets the Crypto Telegram

October 7, 2025

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

Not too many people cared that Google cut a deal with Alibaba’s ANT financial services outfit. My view is that at some point down the information highway, the agreement will capture more attention. Today (September 27, 2025), I want to highlight another example of Google’s getting a telegram about crypto.

Finding inspiration? Yep. Thanks, Venice.ai. Good enough.

Navigate to what seems to be just another crypto mining news announcement: “Cipher Mining Signs 168 MW, 10-Year AI Hosting Agreement with Fluidstack.”

So what’s a Cipher Mining? This is a publicly traded outfit engaged in crypto mining. My understanding is that the company’s primary source of revenue is bitcoin mining. Some may disagree, pointing to its business as “owner, developer and operator of industrial-scale data centers.”

The news release says:

[Cipher Mining] announces a 10-year high-performance computing (HPC) colocation agreement with Fluidstack, a premier AI cloud platform that builds and operates HPC clusters for some of the world’s largest companies.

So what?

The news release also offers this information:

Google will backstop $1.4 billion of Fluidstack’s lease obligations to support project-related debt financing and will receive warrants to acquire approximately 24 million shares of Cipher common stock, equating to an approximately 5.4% pro forma equity ownership stake, subject to adjustment and a potential cash settlement under certain circumstances. Cipher plans to retain 100% ownership of the project and access the capital markets as necessary to fund a portion of the project.

Okay, three outfits: crypto, data centers, and billions of dollars. That’s quite an information cocktail.

Several observations:

- Like the Alibaba / ANT relationship, the move is aligned with facilitating crypto activities on a large scale

- In the best tradition of moving money, Google seems to be involved but not the big dog. I think that Google may indeed be the big dog. Puzzle pieces that fit together? Seems like it to me.

- Crypto and financial services could — note I say “could” — be the hedge against future advertising revenue potholes.

Net net: Worth watching and asking, “What’s the next Google message received from Telegram?” Does this question seem cryptic? It isn’t. Like Meta, Google is following a path trod by a certain outfit now operating in Dubai. Is the path intentional or accidental? Where Google is concerned, everything is original, AI, and quantumly supreme.

Stephen E Arnold, October 7, 2025

Telegram and EU Regulatory Consolidation: Trouble Ahead

October 6, 2025

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

Imagine you are Pavel Durov. The value of TONcoin is problematic. France asked you to curtail some content in a country unknown to the folks who hang out at the bar at the Harrod’s Creek Inn in rural Kentucky. Competitors are announcing plans to implement Telegram-type functions in messaging apps built with artificial intelligence as steel girders. How can the day become more joyful?

Thanks, Midjourney. Good enough pair of goats. One an actual goat and the other a “Greatest of All Time” goat.

The orange newspaper has an answer to that question. “EU Watchdog Prepares to Expand Oversight of Crypto and Exchanges” reports:

Stock exchanges, cryptocurrency companies and clearing houses operating in the EU are set to come under the supervision of the bloc’s markets watchdog…

Crypto currency and some online services (possibly Telegram) operate across jurisdictions. The fragmented rules and regulations allow organizations with sporty leadership to perform some remarkable financial operations. If you poke around, you will find the names of some outfits allied with industrious operators linked to a big country in Asia. Pull some threads, and you may find an unknown Russian space force professional beavering away in the shadows of decentralized financial activities.

The write up points out:

Maria Luís Albuquerque, EU commissioner for financial services, said in a speech last month that it was “considering a proposal to transfer supervisory powers to Esma for the most significant cross-border entities” including stock exchanges, crypto companies and central counterparties.

How could these rules impact Telegram? It is nominally based in the United Arab Emirates? Its totally independent do-good Open Network Foundation works tirelessly from a rented office in Zug, Switzerland. Telegram is home free, right?

No pesky big government rules can ensnare the Messenger crowd.

Possibly. There is that pesky situation with the annoying French judiciary. (Isn’t that country with many certified cheeses collapsing?) One glitch: Pavel Durov is a French citizen. He has been arrested, charged, and questioned about a dozen heinous crimes. He is on a leash and must check in with his grumpy judicial “mom” every couple of weeks. He allegedly refused to cooperate with a request from a French government security official. He is awaiting more thrilling bureaucracy from the French judicial system. How does he cope? He criticizes France, the legal processes, and French officials asking him to do for France what Mr. Durov did for Russia earlier this year.

Now these proposed regulations may intertwine with Mr. Durov’s personal legal situation. As the Big Dog of Telegram, the French affair is likely to have some repercussions for Telegram and its Silicon Valley big tech approach to rules and regulations. EU officials are indeed aware of Mr. Durov and his activities. From my perspective in nowheresville in rural Kentucky, the news in the Financial Times on October 6, 2025, is problematic for Mr. Durov. The GOAT of Messaging, his genius brother, and a close knit group of core engineers will have to do some hard thinking to figure out how to deal with these European matters. Can he do it? Does a GOAT eat what’s available?

Stephen E Arnold, October 6, 2025

AI Service Industry: Titan or Titanic?

October 6, 2025

Venture capitalists believe they have a new recipe for success: Buy up managed-services providers and replace most of the staff with AI agents. So far, it seems to be working. (For the VCs, of course, not the human workers.) However, asserts TechCrunch, “The AI Services Transformation May Be Harder than VCs Think.” Reporter Connie Loizos throws cold water on investors’ hopes:

“But early warning signs suggest this whole services-industry metamorphosis may be more complicated than VCs anticipate. A recent study by researchers at Stanford Social Media Lab and BetterUp Labs that surveyed 1,150 full-time employees across industries found that 40% of those employees are having to shoulder more work because of what the researchers call ‘workslop’ — AI-generated work that appears polished but lacks substance, creating more work (and headaches) for colleagues. The trend is taking a toll on the organizations. Employees involved in the survey say they’re spending an average of nearly two hours dealing with each instance of workslop, including to first decipher it, then decide whether or not to send it back, and oftentimes just to fix it themselves. Based on those participants’ estimates of time spent, along with their self-reported salaries, the authors of the survey estimate that workslop carries an invisible tax of $186 per month per person. ‘For an organization of 10,000 workers, given the estimated prevalence of workslop . . . this yields over $9 million per year in lost productivity,’ they write in a new Harvard Business Review article.”

Surprise: compounding baloney produces more baloney. If companies implement the plan as designed, “workslop” will expand even as the humans who might catch it are sacked. But if firms keep on enough people to fix AI mistakes, they will not realize the promised profits. In that case, what is the point of the whole endeavor? Rather than upending an entire industry for no reason, maybe we should just leave service jobs to the humans that need them.

Cynthia Murrell, October 6, 2025

What a Hoot? First, Snow White and Now This

October 3, 2025

![green-dino_thumb_thumb[3] green-dino_thumb_thumb[3]](https://www.arnoldit.com/wordpress/wp-content/uploads/2025/09/green-dino_thumb_thumb3_thumb.gif) This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

I read “Disney+ Cancellation Page Crashes As Customers Rush to Quit after Kimmel Suspension.” I don’t think too much about Disney, the cost of going to a theme park, or the allegedly chill Walt Disney. Now it is Disney, Disney, Disney. The chant is almost displacing Epstein, Epstein, Epstein.

Somehow the Disney company muffed the bunny with Snow White. I think the film hit my radar when certain short human actors were going to be in a remake of the 1930s’ cartoon “Snow White.” Then then I noted some stories about a new president and an old president who wanted to be the president again or whatever. Most recently, Disney hit the pause button for a late night comedy show. Some people were not happy.

The write up informed me:

With cancellations surging, many subscribers reported technical issues. On Reddit’s r/Fauxmoi, one post read, “The page to cancel your Hulu/Disney+ subscription keeps crashing.”

As a practical matter, the way to stop cancellations is to dial back the resources available to the Web site. Presto. No more cancellations until the server is slowly restored to functionality so it can fall over again.

I am pragmatic. I don’t like to think that information technology professionals (either full time “cast” or part-timers) can’t keep a Web site online. It is 2025. A phone call to a service provider can solve most reliability problems as quickly as the data can be copied to a different data center.

Let me step back. I see several signals in what I will call the cartoon collapse.

- The leadership of Disney cannot rely on the people in the company; for example, the new Snow White and the Web server fell over.

- The judgment of those involved in specific decisions seems to be out of sync with the customers and the stakeholders in the company. Walt had Mickey Mouse aligned with what movie goers wanted to see and what stakeholders expected the enterprise to deliver.

- The technical infrastructure seems flawed. Well, not “seems.” The cancellation server failed.

Disney is an example of what happens when “leadership” has not set up an organization to succeed. Furthermore, the Disney case raises this question, “How many other big, well-known companies will follow this Disney trajectory?” My thought is that the disconnect between “management” staff, customers, stakeholders, and technology is similar to Disney in a number of outfits.

What will be these firms’ Snow White and late night comedian moment?

Stephen E Arnold, October 3, 2025

PS. Disney appears to have raised prices and then offered my wife a $2.99 per month “deal.” Slick stuff.

Hiring Problems: Yes But AI Is Not the Reason

October 2, 2025

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

I read “AI Is Not Killing Jobs, Finds New US Study.” I love it when the “real” news professionals explain how hiring trends are unfolding. I am not sure how many recent computer science graduates, commercial artists, and online marketing executives are receiving this cheerful news.

The magic carpet of great jobs is flaming out. Will this professional land a new position or will the individual crash? Thanks, Midjourney. Good enough.

The write up states: “Research shows little evidence the cutting edge technology such as chatbots is putting people out of work.”

I noted this statement in the source article from the Financial Times:

Research from economists at the Yale University Budget Lab and the Brookings Institution think-tank indicates that, since OpenAI launched its popular chatbot in November 2022, generative AI has not had a more dramatic effect on employment than earlier technological breakthroughs. The research, based on an analysis of official data on the labor market and figures from the tech industry on usage and exposure to AI, also finds little evidence that the tools are putting people out of work.

That closes the doors on any pushback.

But some people are still getting terminated. Some are finding that jobs are not available. (Hey, those lucky computer science graduates are an anomaly. Try explaining that to the parents who paid for tuition, books, and a crash summer code academy session.)

“Companies Are Lying about AI Layoffs” provides a slightly different take on the jobs and hiring situation. This bit of research points out that there are terminations. The write up explains:

American employees are being replaced by cheaper H-1B visa workers.

If the assertions in this write up are accurate, AI is providing “cover” for what is dumping expensive workers and replacing them with lower cost workers. Cheap is good. Money savings… also good. Efficiency … the core process driving profit maximization. If you don’t grasp the imperative of this simply line of reasoning, ask an unemployed or recently terminated MBA from a blue chip consulting firm. You can locate these individuals in coffee shops in cities like New York and Chicago because the morose look, the high end laptop, and carefully aligned napkin, cup, and ink pen are little billboards saying, “Big time consultant.”

The “Companies Are Lying” article includes this quote:

“You can go on Blind, Fishbowl, any work related subreddit, etc. and hear the same story over and over and over – ‘My company replaced half my department with H1Bs or simply moved it to an offshore center in India, and then on the next earnings call announced that they had replaced all those jobs with AI’.”

Several observations:

- Like the Covid thing, AI and smart software provide logical ways to tell expensive employees hasta la vista

- Those who have lost their jobs can become contractors and figure out how to market their skills. That’s fun for engineers

- The individuals can “hunt” for jobs, prowl LinkedIn, and deal with the wild and crazy schemes fraudsters present to those desperate for work

- The unemployed can become entrepreneurs, life coaches, or Shopify store operators

- Mastering AI won’t be a magic carpet ride for some people.

Net net: The employment picture is those photographs of my great grandparents. There’s something there, but the substance seems to be fading.

Stephen E Arnold, October 2, 2025

The EU Does More Than Send US Big Tech to Court; It Sends Messages Too

October 2, 2025

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

The estimable but weird orange newspaper published “EU to Block Big Tech from New Financial Data Sharing System.” The “real” news story is paywalled. (Keep your still functioning Visa and MasterCard handy.)

The write up reports:

Big Tech groups are losing a political battle in Brussels to gain access to the EU’s financial data market…

Google is busy working to bolt its payment system into Ant (linked to Alibaba which may be linked to the Chinese government). Amazon and Meta are big money outfits. And Apple, well, Apple is Apple.

Cartoon of a disaster happily generated by ChatGPT. Remarkable what’s okay and what’s not.

The write up reports:

With the support of Germany, the EU is moving to exclude Meta, Apple, Google and Amazon from a new system for sharing financial data that is designed to enable development of digital finance products for consumers.

The article points out:

In a document sent to other EU countries, seen by the Financial Times, Germany suggested excluding Big Tech groups “to promote the development of an EU digital financial ecosystem, guarantee a level playing field and protect the digital sovereignty of consumers”. EU member states and the European parliament are hoping to reach a deal on the final text of the regulation this autumn. [Editor’s Note: October or November 2025?]

What about the crypto payment systems operating like Telegram’s and others in the crypto “space”? That financial mechanism is not referenced in the write up. Curious? Nope. Out of scope. What about the United Arab Emirates’ activities in digital payments and crypto? Nope. Out of scope. What about China’s overt and shadow digital financial activities? Nope. Out of scope.

What’s in scope is that disruption is underway within the traditional banking system. The EU is more concerned about the US than the broader context of the changes it seems to me.

Stephen E Arnold, October 2, 2025

Deepseek Is Cheap. People Like Cheap

October 1, 2025

![green-dino_thumb_thumb[1] green-dino_thumb_thumb[1]](https://www.arnoldit.com/wordpress/wp-content/uploads/2025/09/green-dino_thumb_thumb1_thumb.gif) This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

I read “Deepseek Has ‘Cracked’ Cheap Long Context for LLMs With Its New Model.” (I wanted to insert “allegedly” into the headline, but I refrained. Just stick it in via your imagination.) The operative word is “cheap.” Why do companies use engineers in countries like India? The employees cost less. Cheap wins out over someone who lives in the US. The same logic applies to smart software; specifically, large language models.

Cheap wins if the product is good enough. Thanks, ChatGPT. Good enough.

According to the cited article:

The Deepseek team cracked cheap long context for LLMs: a ~3.5x cheaper prefill and ~10x cheaper decode at 128k context at inference with the same quality …. API pricing has been cut by 50%. Deepseek has reduced input costs from $0.07 to $0.028 per 1M tokens for cache hits and from $0.56 to $0.28 for cache misses, while output costs have dropped from $1.68 to $0.42.

Let’s assume that the data presented are spot on. The Deepseek approach suggests:

- Less load on backend systems

- Lower operating costs allow the outfit to cut costs to licensee or user

- A focused thrust at US-based large language model outfits.

The US AI giants focus on building and spending. Deepseek (probably influenced to some degree by guidance from Chinese government officials) is pushing the cheap angle. Cheap has worked for China’s manufacturing sector, and it may be a viable tool to use against the incredibly expensive money burning U S large language model outfits.

Can the US AI outfits emulate the Chinese cheap tactic. Sure, but the US firms have to overcome several hurdles:

- Current money burning approach to LLMs and smart software

- The apparent diminishing returns with each new “innovation”. Buying a product from within ChatGPT sounds great but is it?

- The lack of home grown AI talent exists and some visa uncertainty is a bit like a stuck emergency brake.

Net net: Cheap works. For the US to deliver cheap, the business models which involved tossing bundles of cash into the data centers’ furnaces may have to be fine tuned. The growth at all costs approach popular among some US AI outfits has to deliver revenue, not taking money from one pocket and putting it in another.

Stephen E Arnold, October 1, 2025

AI Will NOT Suck Power Like a Kiddie Toy

October 1, 2025

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

The AI “next big thing” has fired up utilities to think about building new plants, some of which may be nuclear. Youthful wizards are getting money to build thorium units. Researchers are dusting off plans for affordable tokamak plasma jobs. Wireless and smart meters are popping up in rural Kentucky. Just in case a big data center needs some extra juice, those wireless gizmos can manage gentle brownouts better than an old-school manual switches.

I read “AI Won’t Use As Much Electricity As We Are Told.” The blog is about utility demand forecasting. Instead of the fancy analytic models used for these forward-looking projections, the author approaches the subject in a somewhat more informal way.

The write up says:

The rise of large data centers and cloud computing produced another round of alarm. A US EPA report in 2007 predicted a doubling of demand every five years. Again, this number fed into a range of debates about renewable energy and climate change. Yet throughout this period, the actual share of electricity use accounted for by the IT sector has hovered between 1 and 2 per cent, accounting for less than 1 per cent of global greenhouse gas emissions. By contrast, the unglamorous and largely disregarded business of making cement accounts for around 7 per cent of global emissions.

Okay, some baseline data from the Environmental Protection Agency in 2007. Not bad: 18 years ago.

The write up notes:

Looking the other side of the market, OpenAI, the maker of ChatGPT, is bringing in around $3 billion a year in sales revenue, and has spent around $7 billion developing its model. Even if every penny of that was spent on electricity, the effect would be little more than a blip. Of course, AI is growing rapidly. A tenfold increase in expenditure by 2030 isn’t out of the question. But that would only double total the total use of electricity in IT. And, as in the past, this growth will be offset by continued increases in efficiency. Most of the increase could be fully offset if the world put an end to the incredible waste of electricity on cryptocurrency mining (currently 0.5 to 1 per cent of total world electricity consumption, and not normally counted in estimates of IT use).

Okay, the idea is that power generation professionals are implementing “logical” and “innovative” tweaks. These squeeze more juice from the lemon so to speak.

The write up ends with a note that power generation and investors are not into “degrowth”; that is, the idea that investments in new power generation facilities may not be as substantial as noted. The thirst for new types of power generation warrants some investment, but a Sputnik response is unwarranted.

Several observations:

- Those in the power generation game like the idea of looser regulations, more funding, and a sense of urgency. Ignoring these boosters is going to be difficult to explain to stakeholders.

- The investors pumping money into mini-reactors and more interesting methods want a payoff. The idea that no crisis looms is going to make some nervous, very nervous.

- Just don’t worry.

I would suggest, however, that the demand forecasting be carried out in a rigorous way. A big data center in some areas may cause some issues. The costs of procuring additional energy to meet the demands of some relaxed, flexible, and understanding outfits like Google-type firms may play a role in the “more power generation” push.

Stephen E Arnold, October 1, 2025

Google Is Entering Its Janus Era

September 30, 2025

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

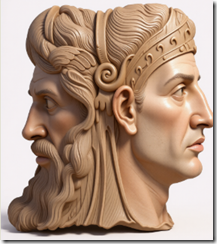

The Romans found the “god” Janus a way to demarcate the old from the new. (Yep, January is a variant of this religious belief: A threshold between old and new.

Venice.ai imagines Janus as a statue.

Google is at its Janus moment. Let me explain.

The past at Google was characterized by processing a two or three word “query” and providing the user with a list of allegedly relevant links. Over time, the relevance degraded and the “pay to play” ads began to become more important. Ed Zitron identified Prabhakar Raghavan as the Google genius associated with this money-making shift. (Good work, Prabhakar! Forget those Verity days.)

The future is signaled with two parallel Google tactics. Let me share my thoughts with you.

The first push at Google is its PR / marketing effort to position itself as the Big Dog in technology. Examples range from Google’s AI grand wizard passing judgment on the inferiority of a competitor. A good example of this approach is the Futurism write up titled “CEO of DeepMind Points Out the Obvious: OpenAI Is Lying about Having PhD Level AI.” The outline of Google’s approach is to use a grand wizard in London to state the obvious to those too stupid to understand that AI marketing is snake oil, a bit of baloney, and a couple of measuring cups of jargon. Thanks for the insight, Google.

The second push is that Google is working quietly to cut what costs it can. The outfit has oodles of market cap, but the cash burn for [a] data centers, [b] hardware and infrastructure, [c] software fixes when kids are told to eat rocks and glue cheese on pizza (remember the hallucination issues?), and [d] emergency red, yellow, orange, or whatever colors suits the crisis convert directly into additional costs. (Can you hear Sundar saying, “I don’t want to hear about costs. I want Gmail back online. Why are you still in my office?)

As a result of these two tactical moves, Google’s leadership is working overtime to project the cool, calm demeanor of a McKinsey-type consultant who just learned that his largest engagement client has decided to shift to another blue-chip firm. I would consider praying to Janus if that we me in my consulting role. I would also think about getting reassigned to project involving frequent travel to Myanmar and how to explain that to my wife.

Venice.ai puts a senior manager at a big search company in front of a group of well-paid but very nervous wizards.

What’s an example of sending a cost signal to the legions of 9-9-6 Googlers? Navigate to “Google Isn’t Kidding Around about Cost Cutting, Even Slashing Its FT subscription.” [Oh, FT means the weird orange newspaper, the Financial Times.] The write up reports as actual factual that Google is dumping people by “eliminating 35 percent of managers who oversee teams of three people or fewer.” Does that make a Googler feel good about becoming a Xoogler because he or she is in the same class as a cancelled newspaper subscription. Now that’s a piercing signal about the value of a Googler after the baloney some employees chew through to get hired in the first place.

The context for these two thrusts is that the good old days are becoming a memory. Why? That’s easy to answer. Just navigate to “Report: The Impact of AI Overviews in the Cultural Sector.” Skip the soft Twinkie filling and go for the numbers. Here’s a sampling of why Google is amping up its marketing and increasing its effort to cut what costs it can. (No one at Google wants to admit that the next big thing may be nothing more than a repeat of the crash of the enterprise search sector which put one executive in jail and others finding their future elsewhere like becoming a guide or posting on LinkedIn for a “living.”)

Here are some data and I quote from “Report: The Impact…”:

- Organic traffic is down 10% in early 2025 compared to the same period in 2024. On the surface, that may not sound bad, but search traffic rose 30% in 2024. That’s a 40-point swing in the wrong direction.

- 80% of organizations have seen decreases in search traffic. Of those that have increased their traffic from Google, most have done so at a much slower rate than last year.

- Informational content has been hit hardest. Visitor information, beginner-level articles, glossaries, and even online collections are seeing fewer clicks. Transactional content has held up better, so organizations that mostly care about their event and exhibition pages might not be feeling the effect yet.

- Visibility varies. On average, organizations appear in only 6% of relevant AI Overviews. Top performers are achieving 13% and they tend to have stronger SEO foundations in place.

My view of this is typical dinobaby. You Millennials, GenX, Y, Z, and Gen AI people will have a different view. (Let many flowers bloom.):

- Google is for the first time in its colorful history faced with problems in its advertising machine. Yeah, it worked so well for so long, but obviously something is creating change at the Google

- The mindless AI hyperbole has not given way to direct criticism of a competitor who has a history of being somewhat unpredictable. Nothing rattles the cage of big time consultants more than uncertainty. OpenAI is uncertainty on steroids.

- The impact of Google’s management methods is likely to be a catalyst for some volatile compounds at the Google. Employees and possibly contractors may become less docile. Money can buy their happiness I suppose, but the one thing Google wants to hang on to at this time is money to feed the AI furnace.

Net net: Google is going to be an interesting outfit to monitor in the next six months. Will the European Union continue to send Google big bills for violating its rules? Will the US government take action against the outfit one Federal judge said was a monopoly? Will Google’s executive leadership find itself driven into a corner if revenues and growth stall and then decline? Janus, what do you think?

Stephen E Arnold, September 30, 2025