Big Tech Defines Material: What Does That Really Mean to Oligopolistic-Type Outfits?

September 16, 2021

I noted a US government study called “Non HSR Reported Acquisitions by Select Technology Platforms: 2010-2019: FTC Study.” The report, assuming it is spot on, suggests that large companies interpreted the word “material” differently from what some financial / accountant types think it means; for example, “Items are considered to be material when they have an excessive impact on reported profits, or on individual line items within the financial statements.” [Source: The Google, of course.] Some MBAs and accountants have remarkably flexible connotative skills. Is this a Deloitte Touche-type touch?

The report states:

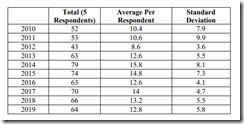

My hunch is that standard deviation is not a hot topic at Zoom happy hours. The standard deviations in the table above suggest that the big tech outfits in the study pretty much redefined “material,” bought stuff and did not make a big deal about it, and chugged along in their cheerfully unregulated state during the period of the study.

The report states:

The five technology platform 6(b) respondents identified 616 non-HSR reportable transactions above $1 million, in addition to 101 Hiring Events and 91 Patent Acquisitions. The respondents reported an additional approximate 60 transactions below $1 million and 160 financial investments. Voting Security (Control) and Asset acquisitions comprise 65% of all of the above transactions. When excluding Hiring Events, Patent Acquisitions, and transactions below $1 million, Voting Security (Control) and Asset acquisitions comprise 85% of the transactions.

I interpret this to mean that the big tech outfits in the sample decided what to report and what to ignore; that is, the deals were not material. There’s that MBA word again.

Here’s another passage I circled:

Most of the transactions that were classified into technology categories were concentrated in the categories of Mobility (mobile devices and device-based software and content, which comprised more than 10% of the acquired firms), Application Software (front-end applications such as CRM, ERP, SCM, BI, commerce and vertical business software, which comprised more than 9% of the acquired firms), and Internet Content & Commerce (internet destination and internet-enabled services, which comprised more than 6% of the acquired firms). In the Mobility and Application Software categories, the number of transactions peaked in 2015; in the Internet Content & Commerce category, the number of transactions peaked in 2011.

Observations:

- Fancy dancing is popular among the companies in the sample; notably, Alphabet/Google, Amazon, Apple, Facebook, and Microsoft

- Regulators, probably with MBAs, looked the other way

- The power of unregulated commercial enterprises makes clear who is in charge of many important technical and social activities.

Interesting stuff, and I am confident that a lawyer with an MBA can explain this misalignment about the meaning of “material.” I wonder if the hints about the behavior of the companies in the sample suggest that we now live in a digital banana republic with the centers of power concentrated among a few corporate entities in their plantation houses.

Stephen E Arnold, September 16, 2021