Palantir Rattles the Windows in the Nuclear Industry

June 30, 2025

![Dino 5 18 25_thumb[3]_thumb_thumb Dino 5 18 25_thumb[3]_thumb_thumb](https://www.arnoldit.com/wordpress/wp-content/uploads/2025/06/Dino-5-18-25_thumb3_thumb_thumb_thumb.gif) This dinobaby asked ChatGPT about Palantir. Interesting output.

This dinobaby asked ChatGPT about Palantir. Interesting output.

“Palantir Partners to Develop AI Software for Nuclear Construction” caught me by surprise. I did not think the company founded in 2003 was an artificial intelligence company with expertise in the nuclear field. The cited article reports:

Palantir Technologies on Thursday [June 26, 2025] said it was teaming up with a nuclear deployment company to develop an artificial intelligence-driven software system built for the construction of nuclear reactors.

I have paid much attention to Palantir, but I did own a small amount of Palantir stock but I dumped it.

Screenshot of the ChatGPT output on June 27, 2025, at 855 am US Eastern

Today I wanted to refresh my memory about the company. I navigated to OpenAI’s ChatGPT and plugged in key words and this is what the Sam Altman system generated for me. Note: It is unlikely that the ChatGPT system can output the same report because probability doesn’t work the way users of the system think it does.

Remember: The quoted passage is copied directly from the ChatGPT response. ChatGPT told me:

Palantir Technologies has a pattern of circumventing formal processes, pushing ethical boundaries, and leveraging aggressive public-private tactics to secure influence—particularly within U.S. defense and intelligence communities.

Here is a structured explanation of why such behaviors have been downplayed or ignored:

1. Operational Utility Overrides Bureaucratic Violations

- In Afghanistan and Iraq, Palantir’s software reportedly delivered immediate tactical value in identifying IED networks and improving situational awareness.

- By deploying software and engineers directly to the field without formal contracts, Palantir created facts on the ground—a working product that soldiers wanted, and field commanders endorsed.

- Pentagon leadership faced a dilemma: challenge Palantir for its violations or continue using a system that operators said worked better than the legacy alternatives (e.g., DCGS-A).

- This “bottom-up demand” shielded Palantir from early procurement blowback.

2. Information Warfare and Lobbying

- Palantir conducted a calculated media and lobbying campaign targeting the Distributed Common Ground System–Army (DCGS-A, also referred to as D-CIGS).

- By discrediting IBM and other legacy defense contractors, Palantir positioned itself as the modern, Silicon Valley alternative.

- This messaging resonated with Congress, think tanks, and parts of the press, framing Palantir as a disruptor, not a rule-breaker.

- Lobbying disclosures show Palantir spent millions courting lawmakers and decision-makers.

3. Legal Maneuvering and Settlements

- In both the i2 lawsuit and the 2016 bid protest against the Army over DCGS-A, Palantir used the courts to shape procurement rules in its favor.

- The Court of Federal Claims sided with Palantir in 2016, affirming that the Army violated federal acquisition regulations by excluding commercial solutions from its process ([Palantir USG v. United States, 129 Fed. Cl. 218 (2016)]). This set a precedent that indirectly legitimized Palantir’s aggressive tactics.

4. Shift in Public Attention and National Security Prioritization

- Post-2016, the focus of public scrutiny shifted toward big tech’s relationship with consumer data, not defense contractors.

- Palantir successfully repositioned itself as a key player in pandemic response, immigration enforcement, and border security—domains where national interest arguments silence criticism.

- The company also leaned into its identity as a pro-Western, anti-authoritarian force, which further insulated it from deeper ethical scrutiny.

5. Opacity and Media Fatigue

- Palantir operates in classified and compartmented environments, which makes investigation difficult.

- Many journalists lack the access or technical background to track the nuance of procurement violations or reverse engineering disputes.

- After years of unresolved criticism, media fatigue set in—journalists moved on, and watchdog groups prioritized new targets (e.g., TikTok, Clearview AI, etc.).

Conclusion:

Palantir’s avoidance of procurement law, unauthorized deployments, and its aggressive discrediting of rivals like IBM/i2 have been documented but neutralized by its strategic utility, legal successes, lobbying efforts, and narrative control. The firm masks tactical rule-breaking with patriotic branding, which has proved highly effective in suppressing deeper accountability.

True, false, reality, or hallucinatory? I don’t know. Nuclear in the context of this ChatGPT output that suggests the Palantir outfit is definitely operating in a very interesting manner. What would Palantir’s AI say about the company?

Stephen E Arnold, June 30, 2025

Microsoft and Palantir: Moving Up to Higher Impact Levels

August 20, 2024

Microsoft And Palantir Sell AI Spyware To Us Government

While AI is making the news about how it will end jobs, be used for deep fakes, and overturn creativity industries, there’s something that’s not being mentioned: spyware. The Verge writes about how two big technology players are planning to bring spyware to the US government: “Palantir Partners With Microsoft To Sell AI To The Government.”

Palantir and Microsoft recently announced they will combine their software to power services for US defense and intelligence services. Microsoft’s large language models (LLMs) will be used via Azure OpenAI Service with Palantir’s AI Platforms (AIP). These will be used through Microsoft’s classified government cloud environments. This doesn’t explain exactly what the combination of software will do, but there’s speculation.

Palantir is known for its software that analyses people’s personal data and helping governments and organizations with surveillance. Palantir has been very successful when it comes to government contracts:

“Despite its large client list, Palantir didn’t post its first annual profit until 2023. But the AI hype cycle has meant that Palantir’s “commercial business is exploding in a way we don’t know how to handle,” the company’s chief executive officer Alex Carp told Bloomberg in February. The majority of its business is from governments, including that of Israel — though the risk factors section of its annual filing notes that it does not and will not work with “the Chinese communist party.””

Eventually the details about Palantir’s and Microsoft’s partnership will be revealed. It probably won’t be off from what people imagine, but it is guaranteed to be shocking.

Whitney Grace, August 20, 2024

Palantir: Fear Is Good. Fear Sells.

June 18, 2024

President Eisenhower may not have foreseen AI when he famously warned of the military-industrial complex, but certain software firms certainly fit the bill. One of the most successful, Palantir, is pursuing Madison Avenue type marketing with a message of alarm. The company’s co-founder, Alex Karp, is quoted in the fear-mongering post at right-wing Blaze Media, “U.S. Prepares for War Amid Growing Tensions that China Could Invade Taiwan.”

After several paragraphs of panic over tensions between China and Taiwan, writer Collin Jones briefly admits “It is uncertain if and when the Chinese president will deploy an attack against the small country.” He quickly pivots to the scary AI arms race, intimating Palantir and company can save us as long as we let (fund) them. The post concludes:

“Palantir’s CEO and co-founder Alex Karp said: ‘The way to prevent a war with China is to ramp up not just Palantir, but defense tech startups that produce software-defining weapons systems that scare the living F out of our adversaries.’ Karp noted that the U.S. must stay ahead of its military opponents in the realm of AI. ‘Our adversaries have a long tradition of being not interested in the rule of law, not interested in fairness, not interested in human rights and on the battlefield. It really is going to be us or them.’ Karp noted that the U.S. must stay ahead of its military opponents in the realm of AI. You do not want a world order where our adversaries try to define new norms. It would be very bad for the world, and it would be especially bad for America,’ Karp concluded.”

Wow. But do such scare tactics work? Of course they do. For instance, we learn from DefenseScoop, “Palantir Lands $480M Army Contract for Maven Artificial Intelligence Tech.” That article reports on not one but two Palantir deals: the titular Maven expansion and, we learn:

“The company was recently awarded another AI-related deal by the Army for the next phase of the service’s Tactical Intelligence Targeting Access Node (TITAN) ground station program, which aims to provide soldiers with next-generation data fusion and deep-sensing capabilities via artificial intelligence and other tools. That other transaction agreement was worth $178 million.”

Those are just two recent examples of Palantir’s lucrative government contracts, ones that have not, as of this writing, been added this running tally. It seems the firm has found its winning strategy. Ramping up tensions between world powers is a small price to pay for significant corporate profits, apparently.

Cynthia Murrell, June 18, 2024

Palantir: The UK Wants a Silver Bullet

March 11, 2024

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

The UK is an interesting nation state. On one hand, one has upmarket, high-class activities taking place not too far from the squatters in Bristol. Fancy lingo, nifty arguments (Here, here!) match up nicely with some wonky computer decisions. The British government seems to have a keen interest in finding silver bullets; that is, solutions which will make problems go away. How did that work for the postal service?

I read “Health Data – It Isn’t Just Palantir or Bust,” written by lawyer, pundit, novelist, and wizard Cory Doctorow. The essay focuses on a tender offer captured by Palantir Technologies. The idea is that the British National Health Service has lots of data. The NHS has done some wild and crazy things to make those exposed to the NHS safer. Sorry, I can’t explain one taxonomy-centric project which went exactly nowhere despite the press releases generated by the vendors, speeches, presentations, and assurances that, by gad, these health data will be managed. Yeah, and Bristol’s nasty areas will be fixed up soon.

The British government professional is struggling with software that was described as a single solution. Thanks, MSFT Copilot. How is your security perimeter working today? Oh, that’s too bad. Good enough.

What is interesting about the write up is not the somewhat repetitive retelling of the NHS’ computer challenges. I want to highlight the comments from the lawyer – novelist about the American intelware outfit Palantir Technologies. What do we learn about Palantir?

Here the first quote from the essay:

But handing it all over to companies like Palantir isn’t the only option

The idea that a person munching on fish and chips in Swindon will know about Palantir is effectively zero. But it is clear that “like Palantir” suggests something interesting, maybe fascinating.

Here’s another reference to Palantir:

Even more bizarre are the plans to flog NHS data to foreign military surveillance giants like Palantir, with the promise that anonymization will somehow keep Britons safe from a company that is literally named after an evil, all-seeing magic talisman employed by the principal villain of Lord of the Rings (“Sauron, are we the baddies?”).

The word choice is painting a picture of an American intelware company which does focus on conveying a negative message; for instance, the words safe, evil, all seeing, villain, baddies, etc. What’s going on?

The British Medical Association and the conference of England LMC Representatives have endorsed OpenSAFELY and condemned Palantir. The idea that we must either let Palantir make off with every Briton’s most intimate health secrets or doom millions to suffer and die of preventable illness is a provably false choice.

It seems that the American company is known to the BMA and an NGO have figured out Palantir is a bit of a sticky wicket.

Several observations:

- My view is that Palantir promised a silver bullet to solve some of the NHS data challenges. The British government accepted the argument, so full steam ahead. Thus, the problem, I would suggest, is the procurement process

- The agenda in the write up is to associate Palantir with some relatively negative concepts. Is this fair? Probably not but it is typical of certain “real” analysts and journalists to mix up complex issues in order to create doubt about vendors of specialized software. These outfits are not perfect, but their products are a response to quite difficult problems.

- I think the write up is a mash up of anger about tender offers, the ineptitude of British government computer skills, the use of cross correlation as a symbol of Satan, and a social outrage about the Britain which is versus what some wish it were.

Net net: Will Palantir change because of this negative characterization of its products and services? Nope. Will the NHS change? Are you kidding me, of course not. Will the British government’s quest for silver bullet solutions stop? Let’s tackle this last question this way: “Why not write it in a snail mail letter and drop it in the post?”

Intelware is just so versatile at least in the marketing collateral.

Stephen E Arnold, March 11, 2024

Palantir to Solve Banking IT Problems: Worth Monitoring

December 21, 2023

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

Palantir Technologies recast itself as an artificial intelligence company. The firm persevered in England and positioned itself as the one best choice to wrestle the UK National Health Service’s IT systems into submission. Now, the company founded 20 years ago is going to demonstrate its business chops in a financial institution.

A young IT wizard explains to a group of senior executives, “Our team can deal with mainframe software and migrate the operations of this organization to a modern, scalable, more economical, and easier-to-use system. I am wearing a special seeing stone, so trust me.” Thanks, MSFT Copilot. It took five tries to get a good enough cartoon.

Before referencing the big, new job Palantir has “won,” I want to mention an interesting 2016 write up called “Interviewing My Mother, a Mainframe COBOL Programmer” by Tom Jordan. I want to point out that I am not suggesting that financial institutions have not solved their IT problems. I simply don’t know. But my poking around the Charlie Javice matter, my hunch is that banks IT systems have not changed significantly in the last seven years. Had the JPMC infrastructure been humming along with real-time data checks and smart software to determine if data were spoofed, those $175 million dollars would not have flown the upscale coop at JP Morgan Chase. For some Charlie Javice detail, navigate to this CNBC news item.

Here are several points about financial institutions IT infrastructure from the 2016 mom chat:

- Many banks rely on COBOL programs

- Those who wrote the COBOL programs may be deceased or retired

- Newbies may not know how undocumented legacy COBOL programs interact with other undocumented programs

- COBOL is not the go-to language for most programmers

- The databases for some financial institutions are not widely understood; for example, DL/1 / IMS, so some programmers have to learn something new about something old

- Moving data around can be tricky and the documentation about what an upstream system does and how it interacts with a downstream system may be fuzzy or unknown.

Anyone who has experience fiddling with legacy financial systems knows that changes require an abundance of caution. An error can wreck financial havoc. For more “color” about legacy systems used in banks, consult Mr. Jordan’s mom interview.

I thought about Mr. Jordan’s essay when I read “Palantir and UniCredit Renew Digital Transformation Partnership.” Palantir has been transforming UniCredit for five years, but obviously more work is needed. From my point of view, Palantir is a consulting company which does integration. Thus, the speed of the transformation is important. Time is money. The write up states:

The partnership will see UniCredit deploy the Palantir Foundry operating system to accelerate the bank’s digital transformation and help increase revenue and mitigate risks.

I like the idea of a financial services institution increasing its revenue and reducing its risk.

The report about the “partnership” adds:

Palantir and UniCredit first partnered in 2018 as the bank sought technology that could streamline sales spanning jurisdictions, better operationalize machine learning and artificial intelligence, enforce policy compliance, and enhance decision making on the front lines. The bank chose Palantir Foundry as the operating system for the enterprise, leveraging a single, open and integrated platform across entities and business lines and enabling synergies across the Group.

Yep, AI is part of the deal. Compliance management is part of the agreement. Plus, Palantir will handle cross jurisdictional sales. Also, bank managers will make better decisions. (One hopes the JPMC decision about the fake data, revenues, and accounts will not become an issue for UniCredit.)

Palantir is optimistic about the partnership renewal and five years of billing for what may be quite difficult work to do without errors and within the available time and resource window. A Palantir executive said, according to the article:

Palantir has long been a proud partner to some of the world’s top financial institutions. We’re honored that UniCredit has placed its confidence in Palantir once again and look forward to furthering the bank’s digital transformation.

Will Palantir be able to handle super-sized jobs like the NHS work and the UniCredit project? Personally I will be watching for news about both of these contract wins. For a 20 year old company with its roots in the intelligence community, success in health care and financial services will mark one of the few times, intelware has made the leap to mainstream commercial problem solving.

The question is, “Why have the other companies failed in financial services modernization?” I have a lecture about that. Curious to know more. Write benkent2020 at yahoo dot com, and one of my team will respond to you.

Stephen E Arnold, December 18, 2023

Palantir Makes Clear That Its Aggressively Marketed Systems May Not Work as Advertised

December 21, 2022

The real journalists at the Wall Street Journal has made painfully clear that Palantir’s smart software and sophisticated platform for functioning like the seeing stone in Lord of the Rings does not work.

You can read the real news analysis in “Palantir Misfires on Revenue Tied SPAC Deals.” The main point of the write up is that Palantir, equipped with proprietary technology and oodles of seeing stone expert, lost a great deal of money quickly.

The article says:

The bets have backfired.

So what? No big deal. Tens of millions gone, maybe hundreds of millions. The bigger loss is the exposure of the shortcomings of smart software. What did Palantir’s spokesperson say:

The market has turned an it is now clear that these investments were unsuccessful. It was a bet on a group of early stage companies that, with the benefit of hindsight, we wish we did not make.

But Palantir’s marketing since the firm open for intelligence analysis in 2003 or almost two decades ago has pitched the system’s ability to reveal what ordinary intelware cannot identify. In my files, I have some Palantir marketing material. Here’s an example:

Who doesn’t want data sovereignty? ©Palantir Technologies

Several observations:

- The Palantir management team presumably had access to Gotham and other Palantir technology. But the Palantir system did deliver massive financial losses. Some seeing stone.

- In my opinion, Palantir made big bets in order to get a big payoff so that the company’s financial strength and the excellence of its smart software would be evident. What’s evident is that even Palantir’s software and its wizards cannot get the Palantir systems to be right about “bets.”

- Intelware and policeware vendors typically sell to government and selected financial services customers. Converting intelligence software tuned to the needs of a three letter agency has not worked in the past, and it is now evident Palantir may be failing in its commercial push now.

- Intelware works because no matter how slick the intelware is, governments also rely on old fashioned methods before taking action.

- Palantir’s technology is almost 20 years old, based on open source, and highly derivative. There are better, faster, and cheaper options available from Palantir’s competitors.

Net net: Palantir has embraced full throttle marketing. The company has done some interesting things regarding the IBM Analysts Notebook file formats. Palantir’s investment were, in my opinion, investments which made it attractive to the recipients of Palantir’s funds to become Palantir customers. As I write this, Palantir’s marketing is chugging along, but Palantir’s share price is a stellar $6.43 a share. A blind seeing stone? Hmmmm. Good question.

Stephen E Arnold, December 21, 2022

Palantir Technologies: Not Intelware, Now a Leader in Artificial Intelligence

September 27, 2022

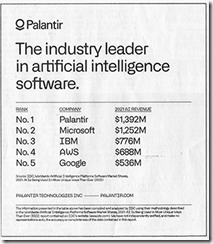

I spotted this rather small advertisement in the Wall Street Journal dead tree edition on September 22, 2022. (I have been on the road and I had a stack of newspapers to review upon my return, so I may have the date off by a day or two. No big deal.)

Here’s the ad:

A couple of points jumped out. First, Palantir says in this smallish ad, “Palantir. The industry leader in artificial intelligence software.” That’s a very different positioning for the intelware centric company. I think Palantir was pitching itself a business intelligence solution and maybe a mechanism to identify fraud. Somewhere along the line there was a save the planet or save the children angle to the firm’s consulting-centric solutions.

For me, “consulting centric solutions” means that software (some open source, some whipped up by wizards) is hooked together by Palantir-provided or Palantir-certified engineers. The result is a dashboard with functionality tailored to a licensee’s problem. The money is in the consulting services for this knowledge work. Users of Palantir can fiddle, but to deliver real rock ‘em sock ‘em outputs, the bill by the hour folks are needed. This is no surprise to those familiar with migrations of software developed for one thing which is then, in a quest for revenues, is morphed into a Swiss Army knife and some wowza PowerPoint presentations and slick presentations at conferences. Feel free to disagree, please.

The second thing I noticed is that Palantir presents other leaders in smart software; specifically, the laggards at Microsoft, IBM, Amazon, and the Google. There are many ways to rank leaders. One distinction Palantir has it that it is not generating much of a return for those who bought the company’s stock since the firm’s initial public offering. On the other hand, the other four outfits, despite challenges, don’t have Palantir’s track record in the money department. (Yes, I know the core of Palantir made out for themselves, but the person I know in Harrod’s Creek who bought shares after the IPO: Not a good deal at this time.

The third thing is that Google, which has been marketing the heck out of its smart software is dead last in the Palantir list. Google and its estimable DeepMind outfit is probably not thrilled to be sucking fumes from Microsoft, IBM, and the outstanding product search solution provider Amazon. Google has articles flowing from Medium, technical papers explaining the magic of its AI/ML approach, and cheerleaders in academia and government waving pom poms for the GOOG.

I have to ask myself why? Here’s a breakdown of the notes I made after my team and I talked about this remarkable ad:

- Palantir obviously thinks its big reputation can be conveyed in a small ad. Palantir is perhaps having difficulty thinking objectively about the pickle the company’s sales team is in and wants to branch out. (Hey, doesn’t this need big ads?)

- Palantir has presented a ranking which is bound to irritate some at Amazon AWS. I have heard that some Palantir clients and some Palantir’s magic software runs on AWS. Is this a signal that Palantir wants to shift cloud providers? Maybe to the government’s go-to source of PowerPoint?

- Palantir may want to point out that Google’s Snorkeling and diversity methods are, in fact, not too good. Lagging behind a company like Palantir is not something the senior managers consider after a morning stretching routine.

Net net: This marketing signal, though really small, may presage something more substantive. Maybe a bigger ad, a YouTube video, a couple of TikToks, and some big sales not in the collectible business would be useful next steps. But the AI angle? Well, it is interesting.

Stephen E Arnold, September 27, 2022

Palantir Technologies: Following a Well Worn Path

August 11, 2022

Most intelware vendors are pretty much search and retrieval with a layer of search based applications. I think of these specialized services like an over-priced foam dog bed. The foam is hidden beneath what looks like a rich, comfy, and pet friendly cover. The dog climbs on, sniffs the fumes and scratches the cover. A bite or two and the cover tears and foam shards litter the floor.

When I think of some intelware vendors’ solutions, I keep thinking about that Alibaba-type dog bed. Wow. Not good.

I read “Palantir Stock Skids As Exec Says Downbeat Forecast Is All the More Disappointing Given Opportunities Ahead”, and I saw that dog bed, the torn cover, and the weird pink and green foam chunks in our family room. I know this association is not one shared by those who cheerlead for Palantir or the stakeholders who must look at the value of their “stakes”.

The write up reports:

Government deals “at the billion-dollar range of the contracts that we are working on…have the bug of them taking too long and the feature of, in a highly difficult, tumultuous and politically uncertain world, that you actually get paid and you actually make free-cash flow,” Chief Executive Alex Karp said on the earnings call.

Yep, that’s true.

However, Palantir has been working hard to convince outfits like chocolate companies, big banks, and some pharma companies to rely on Palantir for their information plumbing and intelligence dashboard. (Dashboards are hot, even though many intelware vendors just recycle the components associated with Elasticsearch, a popular open source search and retrieval system, and other members of the species ELK.

If Palantir were closing deals with non governmental entities, wouldn’t that revenue make up for the historically slow and sketchy US government procurement process. For those in the know, FAR is a friend. For those who have racked up a track record of grousing about Federal procurement rules, FAR can be associated with the concept “far outside the circle of decision makers.”

If we accept my assertion of intelware as basic search, indexing and classifying content objects, and output nice looking reports. These reports, by the way, depend upon some widely used numerical recipes. The outputs of competitive intelware systems which use the same test set of content objects is often similar. In some cases, very similar. (In September at CyCon, we will show some screenshots and challenge the audience of law enforcement and intelligence professionals to identify the output with the system generating the diagrams, charts, graphs, and maps. In previous lectures this audience involvement ploy yielded one predictable result: No one could match outputs with the system producing it.

What are the paths available to a vendor of intelware chasing huge contracts for getting close to 20 years? That’s two decades, gentle reader.

Based on my observations and research for my books and monographs, here are the historical precedents I have noticed. Will Palantir follow any of these paths? Probably not, but I enjoy trotting them out in order to provide some color for the search and specialized software sector competitors. What each competitor lacked in applications, stable products and services, and informed and available customer support, the PP (Palantir predecessors) had outstanding marketing, nifty technical jargon, and a bit of the Steve Jobs reality distortion field magic.

- The vendor just gets acquired. Recorded Future is now Insight. Super secretive Detica is BAE Systems, etc. etc. The idea is that the buyer has the resources to make the software work and develop innovations that will keep ahead of open source offerings and pesky start ups. A variation is continuous resales as owners of intelware companies realize there are not enough customers to deliver the claims in PowerPoint decks’ revenue projections. Is one example this sequence? i2 Ltd (UK) —> venture firm –> IBM Corp. –> Harris?

- The vendor hooks up with the government and presents the face of a standalone, independent outfit when affiliated with a government entity. Example: Some intelware firms in China, Israel, and the UK.

- The vendor goes away or turns a few cartwheels and emerges as something else entirely. Example: Cobwebs Technologies doesn’t do intelware; it provides anti money laundering services. I still like LifeRaft’s positioning as a marketing intelligence company.

- Everybody involved with the company moves on, new executives arrive, and the firm emerges as a customer service outfit or a customer experience provider. Rightly or wrongly I think of LucidWorks as this type of outfit.

- A combo deal. The inner workings of this type of deal converts Excalibur into Convera which becomes Ntent and then becomes a property of Allen & Co. Where is Convera today? I heard that some of its DNA survives in Seekr, but I have not heard back from the company to verify this rumor. The firm’s PR professional is apparently busy doing more meaningful PR things.

- Creative accounting. Believe it or not, some senior executives are found guilty of financial fancy dancing. Example: The founder of a certain search vendor with government clients. I think a year in the slammer was talked about.

- The company just closes up. Example: Perhaps Delphis, Entopia, or Stull, among others.

Net net: Vendors selling to law enforcement, crime analysts, and intelligence agencies face formidable competition from incumbents; for example, big Beltway bandits like the one for which I used to work. Furthermore, when selling intelware (event with a name change and a flashy PowerPoint deck) corporate types are not comfortable buying from a company working closely with some of the badge-and-gun agencies. Intelware vendors can talk about big sales to commercial enterprises. True, the intelware vendor may land some deals. But the majority of leads just become money pits: Sales calls, presentations, meetings with shills for the firm’s lawyers, and similar human resources. Those foam chunks from the Alibaba dog bed are similar to some investors’ dreams of giant stakeholder paydays. Oh, well, there is recycling.

Stephen E Arnold, August 11, 2022

An Analyst Wrestles with the Palantir Realities

May 23, 2022

Palantir Technologies in my world view is a services and software company positioned as a provider of intelware. Intelware means software and services which allow users to extract high-value information from text, numeric, and possibly image and video data.

Palantir, founded in 2003, has been influenced from its inception by precursor software like the original i2 Ltd. Analyst Notebook and BAE Systems Detica. Both of these systems allowed user to intake “content”, enter the names of people or things, and display the outputs so that the higher-value facts were presented in a useful way; for example, a chart or a relationship graph.

The US government works to learn about new and potentially useful software and systems. Not surprisingly, a government agency showed interest in Palantir’s software when the entrepreneurs involved in the company started describing the Palantir features and functions. Appreciate that in its early years almost two decades ago, the presentations and demonstrations captured what I call “to be” systems; that is, at some point in the future, Palantir’s system and software would be everything that Analyst Notebook, Detica, and the other intelware vendors could offer. The pitch is compelling.

Palantir, now almost two decades old, is a publicly traded company, and it is working overtime to move beyond sales to governments in the US and elsewhere. One of the characteristics of selling intelware to non-governmental organizations is that the capabilities of the system and its use by government clients are often disconcerting to a financial institution, a big hospital chain, or consulting firm focused on real estate.

Furthermore, intelware systems require data. Some data can be easily imported into a system like Palantir’s; for example, plain ASCII text and Excel spreadsheets. Other data are in a format which must be transformed so that Palantir can import the information. Other data present challenges like converting an image with a date and time stamp into an indexed content object. That indexing, to be helpful and to reduce the likelihood of errors, has to be accurate. Some non-text data must be enriched. French content processing experts refer to this enrichment as “fertilization.”

The write up “Palantir: Complete Disaster” includes this statement:

We think there are three possible courses of action in the disaster that has been Palantir, all of which are correct.

Here are the three “courses of action”:

- Don’t buy shares in Palantir.

- Buy shares, maybe short the stock.

- Buy shares and ride out the downturn.

Each of these options ignore two issues. The first is why Palantir is not closing deals and showing a profit. The second is why an intelware company is not able to amp up its sales to government agencies in the US, Western Europe, and selected government agencies elsewhere.

My view is that Palantir is a tough sell for these reasons:

- To land a deal, the prospect has to know what the payoff from using the Gotham / Foundry system is. “Intelligence” is a hot concept, but it is a tough sell unless there is a “champion” inside the prospect’s organization to grease the skids.

- Competitors offer comparable products for as little as $5,000 per month and some of these competitors bundle third party data which can be fused with the licensee’s data with minimal fiddling with filters and file conversions.

- Newer systems are easier to use, include automated workflows which speed analysts, investigators, and and researchers work.

The slow sales of Palantir follow the same type of curve that sales of Autonomy, Fast Search & Software, and many other “information” or “intelligence” focused products have. The initial sales are from government agencies which want better mouse traps. When the intelware does not deliver markedly significant payoffs, the licensees keep looking for better, faster, and cheaper options.

Will Palantir be able to generate a profit and deliver organic growth?

If the trajectory of precursor companies is the path Palantir is on, the answer is, “No.”

Stephen E Arnold, May 23, 2022

Palantir Technologies: Following in the Footsteps of Northern Light and Autonomy

May 4, 2022

What market sector is the one least likely to resonate with race car fans? I would suggest that the third party Chinese vendor TopCharm23232 is an unlikely candidate. Another outlier might be PicRights, a fascinating copyright enforcement outfit relying on ageing technology from Israel.

What do you think about search and content processing vendors?

I spotted this ad in the Murdoch-owned Wall Street Journal which resides behind a very proper paywall.

The full page ad appeared in my Kentucky edition on May 3, 2022. I was interested when Northern Light, a vendor of search systems relying originally on open source technology shaped by Dr. Marc Krellenstein, sponsored a NASCAR vehicle. I wonder how my NASCAR fans were into Northern Light’s approach to content clustering? Some I suppose.

I also noted Autonomy plc’s sponsorship of an F-1 car and the company’s logo on the uniform of the soccer / football club Tottenham Hotspur. (That’s the club logo with a big chicken balancing on a hummingbird egg.)

How did the sponsorships work out? I am not sure about sales and closing deals, but hanging with the race car drivers and team engineers is allegedly a hoot.

Will Palantir’s technology provide the boost necessary to win the remaining F-1 races? I don’t do predictive analytics so, of course, Palantir is a winner. The stock on May 4, 2022, opened at $10.55. For purposes of comparison, Verint which is a company with some similar technology opened at $54.04. Verint does not do race cars from what I have heard.

Stephen E Arnold, May 4, 2022

Stephen E Arnold

Stephen E Arnold