Beyond LinkedIn

October 26, 2015

Though LinkedIn remains the largest professional networking site, it may be time to augment its hobnobbing potential with one or more others. Search Engine Journal gives us many to choose from in “12 Professional Networking Alternatives to LinkedIn.” Like LinkedIn, some are free, but others offer special features for a fee. Some even focus on local connections. Reporter Albert Costill writes:

“While LinkedIn has proven to be an incredible assist for anyone looking to make professional connections or find employment, there have been some concerns. For starters, the company has been forced to reduce the number of emails it sends out because of complaints. There have also been allegations of the company hacking into member’s emails and a concern that activity on LinkedIn groups are declining.

“That doesn’t mean that you should give up on LinkedIn. Despite any concerns with the network, it still remains one of the best locations to network professionally. It just means that in addition to LinkedIn you should also start networking on other professional sites to cast that wide net that was previously mentioned. I previously shared eight alternatives to LinkedIn like Twylah, Opprtunity, PartnerUp, VisualCV, Meetup, Zerply, AngelList, and BranchOut, but here are twelve more networking sites that you should also consider using in no particular order.”

So between Costill’s lists, there are 20 sites to check out. A few notable entries from this second list: Makerbase is specifically for software creators, and is free to any Twitter users; LunchMeet connects LinkedIn users who would like to network over lunch; Plaxo automatically keeps your cloud-based contact list up-to-date; and the European Xing is the place to go for a job overseas. See the article for many more network-boosting options.

Cynthia Murrell, October 26, 2015

Sponsored by ArnoldIT.com, publisher of the CyberOSINT monograph

The Alphabet Google Thing: The Crunch Cometh

October 22, 2015

I am in a remote location with so so Internet—sometimes. I wanted to capture this write up “Google’s Growing Problem: 50% of People Do Zero Searches per Day on Mobile.” It is not the good old days from 2002 to 2006 for the GOOG. What happens when most of the folks in this third world country in which I sojourn get online? Well, I don’t think that the users will be doing the 2002-2006 search for information. I also think that zippy new users will embrace social media, apps, or maybe not search at all. Smart software can be convenient. According to the write up:

Thus where someone using a desktop/laptop might fulfil their “average” one or two searches per day by typing “Facebook” when they open their browser, on mobile that doesn’t happen because it doesn’t need to happen; they just open the app. For Google, that means it’s losing out, even though Google search is front and centre on every Android phone (as per Google’s instructions as part of its Mobile Application Device Agreement, MADA). People don’t, on average, search very much on mobile.

Is this a cup half full or half empty issue? Maybe Google can sustain its top line revenue growth. I suppose it has little choice, since the company after 15 years is almost completely dependent on a single revenue stream. On the other hand, perhaps the engine which floats the Loon balloons will run out of hot air?

Stephen E Arnold, October 22, 2015

Watson Weekly: Chasing Sales via Ads. Forget Thought Leadership

October 6, 2015

I was exploring the topics business intelligence and Big Data. I was intrigued by “Is Thought Leadership a Waste of Money?” My reaction was, “Nope, thought leadership is good.” Who wants to fool around with regular marketing methods.

What’s the write up say?

I highlighted this passage from a person who does not know about the genesis of Strategy & Business and the somewhat addled Booz, Allen executive who wanted a BAH branded Economist to generate revenue:

Once upon a time back in 1994, Joel Kurtzman, the then-editor-in-chief of Strategy & Business, coined the term “thought leader” as a means for identifying people within the business marketplace that merited our attention. Thought leaders were the individuals within their respective industries who offered fresh, creative ideas and commentary on industry problems and trends. Two decades later, much of today’s thought leadership has gone from original to repetitive. It’s not that business leaders, C-level executives, or entrepreneurs don’t have great ideas or valuable insights. The problem is a bit more complex.

But here’s the shocker. Strategy & Business was a reaction by Booz, Allen & Hamilton to publications and marketing campaigns mounted by other blue chip consulting firms.

Advertising, at least for blue chip firms, was somewhat low brow. The notion of pumping drivel into the in boxes of Fortune 1000 executives was also distasteful. Today advertising is the cat’s pajamas.

IBM is proving that nothing beats banging one’s own drum even if no one knows what the band is playing.

I opened my dead tree edition of the New York Times this morning )October 6, 2015), and what did I see? The work of Ogilvy & Mather? Sure looks like it. Big ad buy. Big images. Big assertions.

Cognitive computing via Watson. Yikes, where is the smarter planet? I did some poking around and came across “Tangled Up in Big Blue: IBM Replaces Smarter Planet With … Bob Dylan.”

IBM began to realize that the message of Smarter Planet — basically that computing is and will be integral to everything, as manifested in innovations such as smart power grids and connected cars — is no longer a differentiator for the business, explained Mr. Iwata. The emerging pattern, as harnessed and fostered by its Watson technology, is that these super computing capabilities can be built into anything digital because they live in the cloud.

IBM’s senior vice president of marketing Jon Iwata allegedly said:

“This will resonate strongly with not only our current clients but…companies and decision makers and software developers who aren’t currently IBM clients.”

The result in the dead tree newspapers I saw presented page upon page of IBM Watson marketing. Here are some of the pages from this morning’s print campaign in the New York Times and the Wall Street Journal:

The massive ad campaign reveals that Watson consists of 100 million lines of code. No comment about bugs counts, however.

Obviously, this snapshot is too small to read. Put down your smartphone and buy the dead tree newspapers. Here are the themes I noted:

- Buzzwords

- Components that you, gentle reader, can assemble like Potassium ferrocyanide in chem lab when the teacher is inattentive

- Images of youthful, diverse people who are obviously into Watson

- Copy, lots of copy.

The information recycles that which is available on the IBM Watson Web site. The difference is that the multi page ads are the equivalent of a Bunker Buster dropped into the somewhat indifferent world of search and content processing. How will the likes of minnows like Coveo, dtSearch, Elasticsearch (now Elastic), Recommind, Sinequa, legions of business analytics firms, the specialists pitching everything from indexing (Smartlogic) to semantics (SenseBot), and all manner of information access vendors scattered across a somewhat Martian like landscape. Sure, there may be water, but can one survive on the stuff?

IBM is skipping the thought leader thing and going right to big buck advertising. I can imagine this scenario taking place in Joe Coffee’s. The IBM marketing team is meeting with the ad agency’s equivalent of Bindy Irwin. The scene is a hip coffee shop near the Watson office in Manhattan.

IBM Watson Wizard (IWW): We need something big to get this Watson bandwagon rolling?

Mad Ave Ad Exec (MAAE): Yes, big. We need to do big.

IWW: Let’s brainstorm here? Do you want another cappuccino with the neat latte art?

MAAE: Sure, sure. But make mine a macchiato.

[IBM Watson executive returns with more cappuccino and one artisan cafe macchiato.]

IWW: Who wants the macchiato? What have you got for me?

MAAE: Okay, we have been talking while you were standing on line? By the way, do you want one of us to pay for the coffee?

IWW: Nah, we’ve got more than a billion to burn. Let’s get to it.

MAAE: Here’s the idea. Imagine putting the Watson cognitive computing message in front of every, and I mean every, New York Times and Wall Street Journal reader. We warm up with some Monday Night Football buys and then, bang, we hit the buyers with the message, “Cognitive computing.”

IWW: Well, print? What about viral videos? What about social media?

MAAE: We will do that. We can pay some mid tier consulting types to send out Watson tweets?

IWW: But that did not get any traction?

MAAE: Tweets are good. We need to provide a big bang to make the tweet thing happen.

IWW: What’s the message?

MAAE: We were thinking think. But 21st century style. We want to go with outthink thing.

IWW: Out think. I like it.

MAAE: Now picture this. You know how everyone learned about chemical symbols in high school?

IWW: Yes, but I got a D.

MAAE: No problem. Here’s the picture. [Ad person grabs napkin and sketches a hexagon with a happy face.

We show the components of the Watson system as little chemical symbols with codes in them.

IWW: Symbols? Codes? It looks like a happy face with an F in it.

MAAE: Grab your mental iPhone. Snap this happy icon with the Fd. You see “face detection.” Fd. Crystal clear. Non verbal. Immediate.

IWW: I don’t understand.

MAAE: Work with me on this. We make a list of the APIs and the buzzwords and put them into a graphic. We call the page “IBM Watson is the platform for cognitive business.”

IWW: Oh, like the structures computational chemists use to visualize complex constructs?

MAAE: What’s a computational structure whatever? I know a happy face thing with a hexagon. This gets the message across. Zap. Like an Instagram, right?

IWW: I get it. I get it.

MAAE: You like it, right? Big bang. Big splash. Big message but simple, clear, easy to grasp.

IWW: How many New York Times and Wall Street Journal readers know what API means?

MAAE: We’ve grab the upside. Wait for it. We will hook the Watson cognitive thing with a superstar. We are thinking Bob Dylan.

IWW: Bob Dylan. I remember him. Butwasn’t there some talk about drugs, political activism, maybe something with Croatia in France?

MAAE: Ancient history and myth. He’s an icon. Picture this. Bob Dylan becomes the image of cognitive computing. Can’t miss. Cannot miss. Winner. We become the messaging for API. Watson APIs will be huge. The chatter about text extraction, image tagging, and concept expansion. Deafening.

IWW: Wow, that sounds almost as powerful as the Jeopardy game show promotion. I really liked that game show thing. Watson won too.

MAAE: Right. That’s the value of post production. Now. One final point. Jules here came up with a great idea while you were waiting on line. We take the rock solid facts about Watson. Jules thinks this was your idea, and it is a great one. Watson. Only 100 million lines of code, you know, more than in a Volkswagen-type fuel emission system. We sprinkle these facts under a headline like “A cognitive business is a business that thinks.” Stir in Dylan and you can write your own ticket in this cognitive computing thing.

IWW: But what about outthink thing? You said the new hook was outthink.

MAAE: Yes, yes, outthink is the glue. Cognitive API outthink. Huge. I will send a contract over to you later today.

IWW: Do you think we will make any sales?

MAAE: Sales? Sure, sure. Winner. Be sure to turn around that contract. We need to get rolling like a rolling stone. Winner.

What other boosters did Watson receive on October 6, 2015. Well, the IBM Big Blue Boss is on CNBC. Not as perky as Bindy, but pretty excited about granting CNBC an exclusive.

One question: What about revenues? You know three years of declining revenue.

Stephen E Arnold, October 6, 2015

Stephen E Arnold, October 6, 2015

A Xoogler Predicts Spike in Online Ad Rates

October 2, 2015

Yep, AOL, which is now part of Verizon, is not the world beater it was in the days of CD ROM spam. Today’s AOL top dog is a former Google wizards, officially known as a Xoogler.

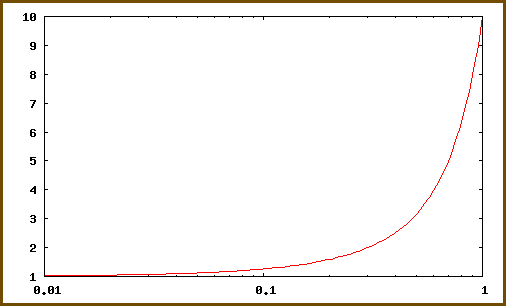

The Xoogler makes an interesting observation, faithfully recorded for the Mad Ave types in “Why AOL’s Tim Armstrong Says Advertising Is about to Get Exponentially More Expensive.” I like the word exponentially. It triggers this type of image in my mind:

Think Super Bowl or pre-indictment World Cup ad rates.

The write up reports that wizard Xoogler says:

“Everyone is spending all their time talking about ad blocking right now,” he said. “Everyone should be spending all of their time talking about why consumers feel the need to block ads.”

The fix, therefore, is more money to reach consumers:

“You’re going to have to pay a lot of money to convert someone,” Mr. Armstrong said.

Good news for the Google? Opportunities for other online ad vendors like Facebook?

Stephen E Arnold, October 2, 2015

Google and YouTube Views: Relevance or Money?

September 24, 2015

I read “Google Charges Advertisers for Fake YouTube Video Views, Say Researchers.” My goodness, will criticism of Alphabet Google continue to escalate?

The trigger for the newspaper article’s story with the somewhat negative headline was an academic paper called “Understanding the Detection of Fake View Fraud in Video Content Portals.” The data presented in the journal by seven European wizards suggests that an Alphabet Google type company knows when a video is viewed by a software robot, not a credit card toting human.

“Fake view fraud” is a snappy phrase.

According to the Guardian newspaper write up about the technical paper:

The researchers’ paper says that while substantial effort has been devoted to understanding fraudulent activity in traditional online advertising such as search and banner ads, more recent forms such as video ads have received little attention. It adds that while YouTube’s system for detecting fake views significantly outperforms others, it may still be susceptible to simple attacks.

Is this a Volkswagen-type spoof? Instead of fiddling with fuel efficiency, certain online video portals are playing fast and loose with charging for video ads not displayed to a human with a PayPal account?

Years ago an outfit approached me with a proposition for a seminar about online advertising fraud. I declined. I am confident that the giant companies and their wizards in the ad biz possess business ethics which put the investment bankers to shame. I recall discussing systems and methods with a couple of with it New Yorkers. The lunch topic was dynamically relaxing the threshold for displaying content in response to certain queries.

My comment pointed to ways to determine if an ad “relevant” was relevant to a higher percentage of user queries. I called this “query and ad matching relaxation.”

I did not include a discussion of “relaxation” in my 2003-2004 study Google Version 2.0, which is now out of print. The systems and methods disclosed in technical papers by researchers who ended up working for large online advertising methods were just more plumbing for smart software.

When an ad does not match a query, that’s the challenge of figuring out what’s relevant and what’s irrelevant.

My thought in 2003 when I started writing the book was that most content was essentially spoofed and sponsored. I wanted to focus on more interesting innovations like the use of game theory in online advertising interfaces and the clever notion of “janitors” which were software routines able to clean up “bad” or “incomplete” data.

As I recall, that New York City guy was definitely interested in the notion of tuning ad results to generate money for the ad distribution and not so much for the advertiser. For me, no interest in lecturing a group of ad execs about their business. These folks can figure out the ins and outs of their business without inputs from an old person in Kentucky.

Mobile and video access to digital content do pose some interesting challenges in the online advertising world. My hunch is that the Alphabet Google type outfits and the intrepid researchers will find common ground. If the meeting progresses smoothly, perhaps a T shirt or mouse pad will be offered to some of the participants?

I remain confident that allegations about slippery behavior in online advertising are baseless. Online advertising is making life better and better for users everyday.

The experience of online advertising is thrilling. I am not sure the experience of receiving unwanted advertisements can be improved? Why read a Web page when one can view an overlay which obscures the desired content? Why work in a quite office? Answer: It is simply easier to hear the auto play videos on many Web pages. Why puzzle over a search results page which blurs sponsored hits from relevant content? By definition, displayed information is relevant information, gentle reader. Do you have a problem with that?

Google, according to the article, will chat up the seven experts who reported on the alleged fraud. I am confident that the confusion in the perceptions of the researchers will be replaced with crystal clear thinking.

Online ad fraud? What a silly notion.

Stephen E Arnold, September 24, 2015

Quote to Note for Ad Lovers

August 28, 2015

The world seems to be focused on the stock market excitement. I want to highlight a paragraph in the dead tree edition of the Wall Street Journal. You might be able to access “Mobile Readers Abound—The Ads, Not So Much” online. Not my problem. Pick up the real newspaper. Flip to the Business & Tech” section and look for this paragraph on page B1 of the August 24, 2015 edition:

It [lagging mobile device ad revenues] is a similar story at News Corp’s Dow Jones & Col, publisher of the Wall Street Journal. More than half of unique visits to the Wall Street Journal Digital Network—which includes the Journal, MarketWatch, Barron’s, and WSJ Magazine—now come from nondesktop devices, but mobile accounts for less than 20 percent of the network’s digital ad revenue, according to a person familiar with the matter.

Interesting comment. So as the world goes mobile, Google goes Alphabet. Publishers perspire.

Without ads, where will online information journey? I would recommend that real journalists who cannot identify co workers as anything other than “a person familiar with the matter” consider podcasting. There may be jobs at Alphabet too.

Stephen E Arnold, August 28, 2015

The Girl with the Advert Tattoo

August 10, 2015

It looks like real publishing companies are now into tattoos or, at least, into leveraging ink’s growing popularity. The Verge reports, “The Desperate Book Industry and ‘Tatvertising’ are a Perfect, Tragic Match.” Reporter Kaitlyn Tiffany tells us that Hachette Austrailia put out the call for a model willing to be tattooed and photographed as part of a promotion for the next Steig Larsson book, “The Girl in the Spider’s Web.” Tiffany likens the effort to a practice, widely considered predatory, that was common just after the turn of the millennium: websites paying those desperate for cash to have ads tattooed on them, (sometimes on their faces!) But, hey, at least those people were paid good money; apparently the reward for this scheme was meant to be the tattoo itself. The article elaborates:

“But why the [heck] does it need to be a real tattoo? When reached for comment, a representative from Razor & JOY, the advertising agency in charge of the campaign, told me, ‘The character of Lisbeth doesn’t do things in half measures — and so we wanted our marketing to capture this passion.’ The representative also explained that the compensation for the woman who is cast would be something… less than monetary: ‘This campaign is an opportunity to give a truly passionate fan a free tattoo that is unique to a strong literary character.’ And a new type of degrading, unpaid labor in the publishing industry was born.”

I’m not sure I’d personally consider this scheme “predatory,” but apparently Tiffany was not alone in her outrage. I visited the link she supplies in her article, and was greeted with a take-back notice; it reads, in part, “The campaign was conceived with good intentions … but some people have been offended. As this was never our intention, we have listened and we have decided we will not continue with the tattoo element of the campaign.” At least the company was wise enough to make a change in response to criticism. I wonder, though, what they will come up with next.

Cynthia Murrell, August 10, 2015

Sponsored by ArnoldIT.com, publisher of the CyberOSINT monograph

Microsoft Top Execs Reaffirm SharePoint Commitment

August 6, 2015

Doubts still remain among users as to whether or not Microsoft is fully committed to the on-premise version of SharePoint. While on-premise has been a big talking point for the SharePoint Server 2016 release, recent news points to more of a hybrid focus, and more excitement from executives regarding the cloud functions. Redmond Magazine sets the story straight with their article, “Microsoft’s Top Office Exec Affirms Commitment to SharePoint.”

The article sums up Microsoft’s stance:

“Microsoft realizes and has acknowledged that many enterprises will want to use SharePoint Server to keep certain data on premises. At the same time, it appears Microsoft is emphasizing the hybrid nature of SharePoint Server 2016, tying the new on-premises server with much of what’s available via Office 365 services.”

No one can know for sure exactly how to prepare for the upcoming SharePoint Server 2016 release, or even future versions of SharePoint. However, staying up to date on the latest news, and the latest tips and tricks, is helpful. For users and managers alike, a SharePoint feed managed by Stephen E. Arnold can be a great resource. The Web site, ArnoldIT.com, is a one-stop-shop for all things search, and the SharePoint feed is particularly helpful for users who need an easy way to stay up to date.

Emily Rae Aldridge, August 6, 2015

Sponsored by ArnoldIT.com, publisher of the CyberOSINT monograph

The Race to Predict Began Years Ago: Journalism as Paleontology

August 4, 2015

I love reading the dead tree edition of the Wall Street Journal. This morning I learned that “Apple and Google Race to Predict What You Want.” The print story appears in the Business & Tech section on B1 and B6 for August 4, 2014. Note that the online version of the story has this title: “Apple and Google Know What You Want before You Do.” There is a difference for me between a “race” and “know.”

Nevertheless, the write up is interesting because of what is omitted. The story seems to fixate on mobile phone users and the notion of an assistant. The first thing I do with my mobile phone is find a way to disable this stuff. I dumped my test Microsoft phone because the stupid Cortana button was in a location which I inadvertently pressed. The Blackberry Classic is equally annoying, defaulting to a screen which takes three presses to escape. The iPhones and Android devices cannot understand my verbal instructions. Try looking up a Russian or Spanish name. Let me know how that works for you.

Now what’s omitted from the write up. Three points struck me as one which warranted a mention:

- Predictive methods are helping in reduce latency and unnecessary traffic (hence cost) between the user’s device and the service with the “answer”

- Advertisers benefit from predictive analytics. Figuring out that someone wants food opens the door to a special offer. Why not cue that up in advance?

- Predictive technology is not limited to a mobile applications. Google invested some bucks into an outfit called Recorded Future. What does Recorded Future do? Answer: Predictive analytics with a focus on time. The GOOG like Apple is mostly time blind.

Predictive methods are not brand, spanking new to those who have followed the antics of physicists since Einstein miracle year. For the WSJ and its canines, isn’t new whatever today seems bright and shiny.

Stephen E Arnold, August 4, 2015

An Obscure Infographic About London Coffee Shops

July 29, 2015

Here’s a unique pair of graphics, particularly of interest for anyone who can see themselves enjoying a cup of joe in London. Gizmodo presents “A Taxonomy of Hip Coffee Shop Names.” The infographic from Information is Beautiful lays out London’s hipster coffee shops by both naming convention and location. Both charts size their entries by popularity– the more popular a shop the bigger disk (coaster?) its name sits upon. The brief write-up sets the scene:

“As you walk down the sidewalk, you see a chalkboard in the distance. As you step a little closer, you smell the deep musk of coffee emanating from an artfully distressed front door. Out steps a man with a beard, a Mac slung under his arm, sipping from small re-useable flat white-sized cup. You’ve stumbled across another hip coffee shop. Now, what’s it called?

“Information is Beautiful … breaks the naming structure down by type: there are ones themed around drugs, chatter, beans, brewing, socialism and more. But they all share one thing in common: they sound just like they could be hand-painted above that scene you just saw.”

So, if you like coffee, London, hipsters, or taxonomy-graphics, take a gander. From Alchemy to Maison d’être to Window, a shop or two are sure to peak the curiosity.

Cynthia Murrell, July 29, 2015

Sponsored by ArnoldIT.com, publisher of the CyberOSINT monograph