YouTube: Another Big Cost Black Hole?

March 25, 2025

Another dinobaby blog post. Eight decades and still thrilled when I point out foibles.

Another dinobaby blog post. Eight decades and still thrilled when I point out foibles.

I read “Google Is in Trouble… But This Could Change Everything – and No, It’s Not AI.” The write up makes the case that YouTube is Google’s big financial opportunity. I agree with most of the points in the write up. The article says:

Google doesn’t clearly explain how much of the $40.3 billion comes from the YouTube platform, but based on their description and choice of phrasing like “primarily include,” it’s safe to assume YouTube generates significantly more revenue than just the $36.1 billion reported. This would mean YouTube, not Google Cloud, is actually Google’s second-biggest business.

Yep, financial fancy dancing is part of the game. Google is using its financial reports as marketing to existing stakeholders and investors who want a part of the still-hot, still-dominant Googzilla. The idea is that the Google is stomping on the competition in the hottest sectors: The cloud, smart software, advertising, and quantum computing.

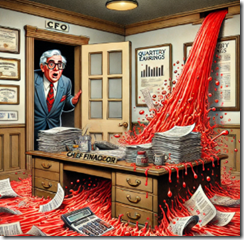

A big time company’s chief financial officer enters his office after lunch and sees a flood of red ink engulfing his work space. Thanks, OpenAI, good enough.

Let’s flip the argument from Google has its next big revenue oil gusher to the cost of that oil field infrastructure.

An article appeared in mid-February 2025. I was surprised that the information in that write up did not generate more buzz in the world of Google watchers. “YouTube by the Numbers: Uncovering YouTube’s Ghost Town of Billions of Unwatched, Ignored Videos” contains some allegedly accurate information. Let’s assume that these data, like most information about online, is close enough for horseshoes or purely notional. I am not going to summarize the methodology. Academics come up with interesting ways to obtain information about closely guarded big company products and services.

The write up says:

the research estimates a staggering 14.8 billion total videos on YouTube as of mid-2024. Unsurprisingly, most of these videos are barely noticed. The median YouTube upload has just 41 views, with 4% garnering no views at all. Over 74% have no comments and 89% have no likes.

Here are a couple of other factoids about YouTube as reported in the Techspot article:

The production values are also remarkably modest. Only 14% of videos feature a professional set or background. Just 38% show signs of editing. More than half have shaky camerawork, and audio quality varies widely in 85% of videos. In fact, 40% are simply music tracks with no voice-over.

And another point I found interesting:

Moreover, the typical YouTube video is just 64 seconds long, and over a third are shorter than 33 seconds.

The most revealing statement in the research data appears in this passage:

… a senior researcher [said] that this narrative overlooks a crucial reality: YouTube is not just an entertainment hub – it has become a form of digital infrastructure. Case in point: just 0.21% of the sampled videos included any kind of sponsorship or advertising. Only 4% had common calls to action such as liking, commenting, and subscribing. The vast majority weren’t polished content plays but rather personal expressions – perhaps not so different from the old camcorder days.

Assuming the data are reasonably good Google has built plumbing whose cost will rival that of the firm’s investments in search and its cloud.

From my point of view, cost control is going to become as important as moving as quickly as possible to the old-school broadcast television approach to content. Hit shows on YouTube will do what is necessary to attract an audience. The audience will be what advertisers want.

Just as Google search has degraded to a popular “experience,” not a resource for individuals who want to review and extract high value information, YouTube will head the same direction. The question is, “Will YouTube’s pursuit of advertisers mean that the infrastructure required to permit free video uploads and storage be sustainable?

Imagine being responsible for capital investments at the Google. The Cloud infrastructure must be upgraded and enhanced. The AI infrastructure must be upgraded and enhanced. The quantum computing and other technology-centric infrastructures must be upgraded an enhanced. The adtech infrastructure must be upgraded and enhanced. I am leaving out some of the Google’s other infrastructure intensive activities.

The main idea is that the financial person is going to have a large job paying for hardware, software, maintenance, and telecommunications. This is a different cost from technical debt. These are on-going and constantly growing costs. Toss in unexpected outages, and what does the bean counter do. One option is to quit and another is to do the Zen thing to avoid have a stroke when reviewing the cost projections.

My take is that a hit in search revenue is likely to add to the firm’s financial challenges. The path to becoming the modern version of William Paley’s radio empire may be in Google’s future. The idea that everything is in the cloud is being revisited by companies due to cost and security concerns. Does Google host some sketchy services on its Cloud?

YouTube may be the hidden revenue gem at Google. I think it might become the infrastructure cost leader among Google’s stellar product line up. Big companies like Google don’t just disappear. Instead the black holes of cost suck them closer to a big event: Costs rise more quickly than revenue.

At this time, Google has three cost black holes. One hopes none is the one that makes Googzilla join the ranks of the street people of online dwell.

Net net: Google will have to give people what they will watch. The lowest common denominator will emerge. The costs flood the CFO’s office. Just ask Gemini what to do.

Stephen E Arnold, March 25, 2025

Comments

One Response to “YouTube: Another Big Cost Black Hole?”

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.