Step 1: Test AI Writing Stuff. Step 2: Terminate Humanoids. Will Outrage Prevent the Inevitable?

July 5, 2023

![Vea4_thumb_thumb_thumb_thumb_thumb_t[1] Vea4_thumb_thumb_thumb_thumb_thumb_t[1]](http://arnoldit.com/wordpress/wp-content/uploads/2023/07/Vea4_thumb_thumb_thumb_thumb_thumb_t1_thumb-2.gif) Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

I am fascinated by the information (allegedly actual factual) in “Gizmodo and Kotaku Staff Furious After Owner Announces Move to AI Content.” Part of my interest is the subtitle:

God, this is gonna be such a f***ing nightmare.

Ah, for whom, pray tell. Probably not for the owners, who may see a pot of gold at the end of the smart software rainbow; for example, Costs Minus Humans Minus Health Care Minus HR Minus Miscellaneous Humanoid costs like latte makers, office space, and salaries / bonuses. What do these produce? More money (value) for the lucky most senior managers and selected stakeholders. Humanoids lose; software wins.

A humanoid writer sits at desk and wonders if the smart software will become a pet rock or a creature let loose to ruin her life by those who want a better payoff.

For the humanoids, it is hasta la vista. Assume the quality is worse? Then the analysis requires quantifying “worse.” Software will be cheaper over a time interval, expensive humans lose. Quality is like love and ethics. Money matters; quality becomes good enough.

Will, fury or outrage or protests make a difference? Nope.

The write up points out:

“AI content will not replace my work — but it will devalue it, place undue burden on editors, destroy the credibility of my outlet, and further frustrate our audience,” Gizmodo journalist Lin Codega tweeted in response to the news. “AI in any form, only undermines our mission, demoralizes our reporters, and degrades our audience’s trust.” “Hey! This sucks!” tweeted Kotaku writer Zack Zwiezen. “Please retweet and yell at G/O Media about this! Thanks.”

Much to the delight of her significant others, the “f***ing nightmare” is from the creative, imaginative humanoid Ashley Feinberg.

An ideal candidate for early replacement by a software system and a list of stop words.

Stephen E Arnold, July 5, 2023

Databricks: Signal to MBAs and Data Wranglers That Is Tough to Ignore

June 29, 2023

![Vea4_thumb_thumb_thumb_thumb_thumb_t[1] Vea4_thumb_thumb_thumb_thumb_thumb_t[1]](http://arnoldit.com/wordpress/wp-content/uploads/2023/06/Vea4_thumb_thumb_thumb_thumb_thumb_t1_thumb-42.gif) Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Do you remember the black and white pictures of the Pullman riots? No, okay. Steel worker strikes in Pittsburgh? No. Scuffling outside of Detroit auto plants? No. Those images may be helpful to get a sense of what newly disenfranchised MBAs and data wranglers will be doing in the weeks and months ahead.

“Databricks Revolutionizes Business Data Analysis with AI Assistant” explains that the Databricks smart software

interprets the query, retrieves the relevant data, reads and analyzes it, and produces meaningful answers. This groundbreaking approach eliminates the need for specialized technical knowledge, democratizing data analysis and making it accessible to a wider range of users within an organization. One of the key advantages of Databricks’ AI assistant is its ability to be trained on a company’s own data. Unlike generic AI systems that rely on data from the internet, LakehouseIQ quickly adapts to the specific nuances of a company’s operations, such as fiscal year dates and industry-specific jargon. By training the AI on the customer’s specific data, Databricks ensures that the system truly understands the domain in which it operates.

MidJourney has delivered an interesting image (completely original, of course) depicting angry MBAs and data wranglers massing in Midtown and preparing to storm one of the quasi monopolies which care about their users, employees, the environment, and bunny rabbits. Will these professionals react like those in other management-labor dust ups?

Databricks appears to be one of the outfits applying smart software to reduce or eliminate professional white collar work done by those who buy $7 lattes, wear designer T shirts, and don wonky sneakers for important professional meetings.

The DEO of Databricks (a data management and analytics firm) says:

By training their AI assistant on the customer’s specific data, Databricks ensures that it comprehends the jargon and intricacies of the customer’s industry, leading to more accurate and insightful analysis.

My interpretation of the article is simple: If the Databricks’ system works, the MBA and data wranglers will be out of a job. Furthermore, my view is that if systems like Databricks works as advertised, the shift from expensive and unreliable humans will not be gradual. Think phase change. One moment you have a solid and then you have plasma. Hot plasma can vaporize organic compounds in some circumstances. Maybe MBAs and data wranglers are impervious? On the other hand, maybe not.

Stephen E Arnold, June 29, 2023

Canada Bill C-18 Delivers a Victory: How Long Will the Triumph Pay Off in Cash Money?

June 23, 2023

News outlets make or made most of their money selling advertising. The idea was — when I worked at a couple of big news publishing companies — the audience for the content would attract those who wanted to reach the audience. I worked at the Courier-Journal & Louisville Times Co. before it dissolved into a Gannett marvel. If a used car dealer wanted to sell a 1980 Corvette, the choice was the newspaper or a free ad in what was called AutoTrader. This was a localized, printed collection of autos for sale. Some dealers advertised, but in the 1980s, individuals looking for a cheap or free way to pitch a vehicle loved AutoTrader. Despite a free option, the size of the readership and the sports news, comics, and obituaries made the Courier-Journal the must-have for a motivated seller.

Hannibal and his war elephant Zuckster survey the field of battle after Bill C-18 passes. MidJourney was the digital wonder responsible for this confection.

When I worked at the Ziffer in Manhattan, we published Computer Shopper. The biggest Computer Shopper had about 800 pages. It could have been bigger, but there were paper and press constraints If I recall correctly. But I smile when I remember that 85 percent of those pages were paid advertisements. We had an audience, and those in the burgeoning computer and software business wanted to reach our audience. How many Ziffers remember the way publishing used to work?

When I read the National Post article titled “Meta Says It’s Blocking News on Facebook, Instagram after Government Passes Online News Bill,” I thought about the Battle of Cannae. The Romans had the troops, the weapons, and the psychological advantage. But Hannibal showed up and, if historical records are as accurate as a tweet, killed Romans and mercenaries. I think it may have been estimated that Roman whiz kids lost 40,000 troops and 5,000 cavalry along with the Roman strategic wizards Paulus, Servilius, and Atilius.

My hunch is that those who survived paid with labor or money to be allowed to survive. Being a slave in peak Rome was a dicey gig. Having a fungible skill like painting zowie murals was good. Having minimal skills? Well, someone has to work for nothing in the fields or quarries.

What’s the connection? The publishers are similar to the Roman generals. The bad guys are the digital rebels who are like Hannibal and his followers.

Back to the cited National Post article:

After the Senate passed the Online News Act Thursday, Meta confirmed it will remove news content from Facebook and Instagram for all Canadian users, but it remained unclear whether Google would follow suit for its platforms. The act, which was known as Bill C-18, is designed to force Google and Facebook to share revenues with publishers for news stories that appear on their platforms. By removing news altogether, companies would be exempt from the legislation.

The idea is that US online services which touch most online users (maybe 90 or 95 percent in North America) will block news content. This means:

- Cash gushers from Facebook- and Google-type companies will not pay for news content. (This has some interesting downstream consequences but for this short essay, I want to focus on the “not paying” for news.)

- The publishers will experience a decline in traffic. Why? Without a “finding and pointing” mechanism, how would I find this “real news” article published by the National Post. (FYI: I think of this newspaper as Canada’s USAToday, which was a Gannett crown jewel. How is that working out for Gannett today?)

- Rome triumphed only to fizzle out again. And Hannibal? He’s remembered for the elephants-through-the-Alps trick. Are man’s efforts ultimately futile?

What happens if one considers, the clicks will stop accruing to the publishers’ Web sites. How will the publishers generate traffic? SEO. Yeah, good luck with that.

Is there an alternative?

Yes, buy Facebook and Google advertising. I call this pay to play.

The Canadian news outlets will have to pay for traffic. I suppose companies like Tyler Technologies, which has an office in Vancouver I think, could sell ads for the National Post’s stories, but that seems to be a stretch. Similarly the National Post could buy ads on the Embroidery Classics & Promotions (Calgary) Web site, but that may not produce too many clicks for the Canadian news outfits. I estimate one or two a month.

Bill C-18 may not have the desired effect. Facebook and Facebook-type outfits will want to sell advertising to the Canadian publishers in my opinion. And without high-impact, consistent and relevant online advertising, state-of-art marketing, and juicy content, the publishers may find themselves either impaled on their digital hopes or placed in servitude to the Zuck and his fellow travelers.

Are these publishers able to pony up the cash and make the appropriate decisions to generate revenues like the good old days?

Sure, there’s a chance.

But it’s a long shot. I estimate the chances as similar to King Charles’ horse winning the 2024 King George V Stakes race in 2024; that is, 18 to 1. But Desert Hero pulled it off. Who is rooting for the Canadian publishers?

Stephen E Arnold, June 23, 2023

News Flash about SEO: Just 20 Years Too Late but, Hey, Who Pays Attention?

June 21, 2023

![Vea4_thumb_thumb_thumb_thumb_thumb_t[1] Vea4_thumb_thumb_thumb_thumb_thumb_t[1]](http://arnoldit.com/wordpress/wp-content/uploads/2023/06/Vea4_thumb_thumb_thumb_thumb_thumb_t1_thumb-24.gif) Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

I read an article which would have been news a couple of decades ago. But I am a dinobaby (please, see anigif bouncing in an annoying manner) and I am hopelessly out of touch with what “real news” is.

An entrepreneur who just learned that in order to get traffic to her business Web site, she will have to spend big bucks and do search engine optimization, make YouTube videos (long and short), and follow Google’s implicit and explicit rules. Sad, MBA, I believe. The Moping Mistress of the Universe is a construct generated by the ever-innovative MidJourney and its delightful Discord interface.

The write up catching my attention is — hang on to your latte — “A Storefront for Robots: The SEO Arms Race Has Left Google and the Web Drowning in Garbage Text, with Customers and Businesses Flailing to Find Each Other.” I wondered if the word “flailing” is a typographic error or misspelling of “failing.” Failing strikes me as a more applicable word.

The thesis of the write up is that the destruction of precision and recall as useful for relevant online search and retrieval is not part of the Google game plan.

The write up asserts:

The result is SEO chum produced at scale, faster and cheaper than ever before. The internet looks the way it does largely to feed an ever-changing, opaque Google Search algorithm. Now, as the company itself builds AI search bots, the business as it stands is poised to eat itself.

Ah, ha. Garbage in, garbage out! Brilliant. The write up is about 4,000 words and makes clear that ecommerce requires generating baloney for Google.

To sum up, if you want traffic, do search engine optimization. The problem with the write up is that it is incorrect.

Let me explain. Navigate to “Google Earned $10 Million by Allowing Misleading Anti-Abortion Ads from Fake Clinics, Report Says.” What’s the point of this report? The answer is, “Google ads.” And money from a controversial group of supporters and detractors. Yes! An arms race of advertising.

Of course, SEO won’t work. Why would it? Google’s business is selling advertising. If you don’t believe me, just go to a conference and ask any Googler — including those wearing Ivory Tower Worker” pins — and ask, “How important is Google’s ad business?” But you know what most Googlers will say, don’t you?

For decades, Google has cultivated the SEO ploy for one reason. Failed SEO campaigns end up one place, “Google Advertising.”

Why?

If you want traffic, like the abortion ad buyers, pony up the cash. The Google will punch the Pay to Play button, and traffic results. One change kicked in after 2006. The mom-and-pop ad buyers were not as important as one of the “brand” advertisers. And what was that change? Small advertisers were left to the SEO experts who could then sell “small” ad campaigns when the hapless user learned that no one on the planet could locate the financial advisory firm named “Financial Specialist Advisors.” Ah, then there was Google Local. A Googley spin on Yellow Pages. And there have been other innovations to make it possible for advertisers of any size to get traffic, not much because small advertisers spend small money. But ad dollars are what keeps Googzilla alive.

Net net: Keep in mind that Google wants to be the Internet. (AMP that up, folks.) Google wants people to trust the friendly beastie. The Googzilla is into responsibility. The Google is truth, justice, and the digital way. Is the criticism of the Google warranted? Sure, constructive criticism is a positive for some. The problem I have is that it is 20 years too late. Who cares? The EU seems to have an interest.

Stephen E Arnold, June 21, 2023

Smart Software: The Dream of Big Money Raining for Decades

June 14, 2023

![Vea4_thumb_thumb_thumb_thumb_thumb_t[1]_thumb_thumb Vea4_thumb_thumb_thumb_thumb_thumb_t[1]_thumb_thumb](http://arnoldit.com/wordpress/wp-content/uploads/2023/06/Vea4_thumb_thumb_thumb_thumb_thumb_t1_thumb_thumb_thumb-2.gif) Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

The illustration — from the crafty zeros and ones at MidJourney — depicts a young computer scientist reveling in the cash generated from his AI-infused innovation.

For a budding wizard, the idea of cash falling around the humanoid is invigorating. It is called a “coder’s high” or Silicon Valley fever. There is no known cure, even when FTX-type implosions doom a fellow traveler to months of litigation and some hard time among individuals typically not in an advanced math program.

Where’s the cyclone of cash originate?

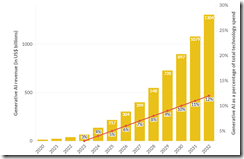

I would submit that articles like “Generative AI Revenue Is Set to Reach US$1.3 Trillion in 2032” are like catnip to a typical feline living amidst the cubes at a Google-type company or in the apartment of a significant other adjacent a blue chip university in the US.

Here’s the chart that makes it easy to see the slope of the growth:

I want to point out that this confection is the result of the mid tier outfit IDC and the fascinating Bloomberg terminal. Therefore, I assume that it is rock solid, based on in-depth primary research, and deep analysis by third-party consultants. I do, however, reserve the right to think that the chart could have been produced by an intern eager to hit the gym and grabbing a sushi special before the good stuff was gone.

Will generative AI hit the $1.3 trillion target in nine years? In the hospital for recovering victims of spreadsheet fever, the coder’s high might slow recovery. But many believe — indeed, fervently hope to experience the realities of William James’s mystics in his Varieties of Religious Experience.

My goodness, the vision of money from Generative AI is infectious. So regulate mysticism? Erect guard rails to prevent those with a coder’s high from driving off the Information Superhighway?

Get real.

Stephen E Arnold, June 12, 2023

Bad News for Humanoids: AI Writes Better Pitch Decks But KFC Is Hiring

June 12, 2023

![Vea4_thumb_thumb_thumb_thumb_thumb_t[1] Vea4_thumb_thumb_thumb_thumb_thumb_t[1]](http://arnoldit.com/wordpress/wp-content/uploads/2023/06/Vea4_thumb_thumb_thumb_thumb_thumb_t1_thumb-15.gif) Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Who would have envisioned a time when MBA with undergraduate finance majors would be given an opportunity to work at a Kentucky Fried Chicken store. What was the slogan about fingers? I can’t remember.

“If You’re Thinking about Writing Your Own Pitch Decks, Think Again” provides some interesting information. I assume that today’s version of Henry Robinson Luce’s flagship magazine (no the Sports Illustrated swimsuit edition) would shatter the work life of those who create pitch decks. A “pitch deck” is a sonnet for our digital era. The phrase is often associated with a group of PowerPoint slides designed to bet a funding source to write a check. That use case, however, is not where pitch decks come into play: Academics use them when trying to explain why a research project deserves funding. Ad agencies craft them to win client work or, in some cases, to convince a client to not fire the creative team. (Hello, Bud Light advisors, are you paying attention.) Real estate professionals created them to show to high net worth individuals. The objective is to close a deal for one of those bizarro vacant mansions shown by YouTube explorers. See, for instance, this white elephant lovingly presented by Dark Explorations. And there are more pitch deck applications. That’s why the phrase, “Death by PowerPoint is real”, is semi poignant.

What if a pitch deck could be made better? What is pitch decks could be produced quickly? What if pitch decks could be graphically enhanced without fooling around with Fiverr.com artists in Armenia or the professionals with orange and blue hair?

The Fortune article states: The study [funded by Clarify Capital] revealed that machine-generated pitch decks consistently outperformed their human counterparts in terms of quality, thoroughness, and clarity. A staggering 80% of respondents found the GPT-4 decks compelling, while only 39% felt the same way about the human-created decks. [Emphasis added]

The cited article continues:

What’s more, GPT-4-presented ventures were twice as convincing to investors and business owners compared to those backed by human-made pitch decks. In an even more astonishing revelation, GPT-4 proved to be more successful in securing funding in the creative industries than in the tech industry, defying assumptions that machine learning could not match human creativity due to its lack of life experience and emotions. [Emphasis added]

Would you like regular or crispy? asks the MBA who wants to write pitch decks for a VC firm whose managing director his father knows. The image emerged from the murky math of MidJourney. Better, faster, and cheaper than a contractor I might add.

Here’s a link to the KFC.com Web site. Smart software works better, faster, and cheaper. But it has a drawback: At this time, the KFC professional is needed to put those thighs in the fryer.

Stephen E Arnold, June 12, 2023

Neeva: Is This Google Killer on the Run?

May 18, 2023

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Sometimes I think it is 2007 doing the déjà vu dance. I read “Report: Snowflake Is in Advanced Talks to Acquire Search Startup Neeva.” Founded by Xooglers, Neeva was positioned to revolutionize search and generate subscription revenue. Along the highway to the pot of gold, Neeva would deliver on point results. How did that pay for search model work out?

According to the article:

Snowflake Inc., the cloud-based data warehouse provider, is reportedly in advanced talks to acquire a search startup called Neeva Inc. that was founded by former Google LLC advertising executive Sridhar Ramaswamy.

Like every other content processing company I bump into, Neeva was doing smart software. Combine the relevance angle with generative AI and what do you get? A start up that is going to be acquired by a firm with some interesting ideas about how to use search and retrieval to make life better.

Are there other search outfits with a similar business model? Sure, Kagi comes to mind. I used to keep track of start ups which had technology that would provide relevant results to users and a big payday to the investors. Do these names ring a bell?

Cluuz

Deepset

Glean

Kyndi

Siderian

Umiboza

If the Snowflake Neeva deal comes to fruition, will it follow the trajectory of IBM Vivisimo. Vivisimo disappeared as an entity and morphed into a big data component. No problem. But Vivisimo was a metasearch and on-the-fly tagging system. Will the tie up be similar to the Microsoft acquisition of Fast Search & Transfer. Fast still lives but I don’t know too many Softies who know about the backstory. Then there is the HP Autonomy deal. The acquisition is still playing out in the legal eagle sauna.

Few care about the nuances of search and retrieval. Those seemingly irrelevant details can have interesting consequences. Some are okay like the Dassault Exalead deal. Others? Less okay.

Stephen E Arnold, May 18, 2023

The Gray Lady: Objective Gloating about Vice

May 15, 2023

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Do you have dreams about the church lady on Saturday Night Live. That skit frightened me. A flashback shook my placid mental state when I read “Vice, Decayed Digital Colossus, Files for Bankruptcy.” I conjured up without the assistance of smart software, the image of Dana Carvey talking about the pundit spawning machine named Vice with the statement, “Well, isn’t that special?”

The New York Times’s article reported:

Vice Media filed for bankruptcy on Monday, punctuating a years long descent from a new-media darling to a cautionary tale of the problems facing the digital publishing industry.

The write up omits any reference to the New York Times’s failure with its own online venture under the guidance of Jeff Pemberton, the flame out with its LexisNexis play, the fraught effort to index its own content, and the misadventures which have become the Wordle success story. The past Don Quixote-like sallies into the digital world are either Irrelevant or unknown to the current crop of Gray Lady “real” news hounds I surmise.

The article states:

Investments from media titans like Disney and shrewd financial investors like TPG, which spent hundreds of millions of dollars, will

be rendered worthless by the bankruptcy, cementing Vice’s status among the most notable bad bets in the media industry. [Emphasis added.]

Well, isn’t that special? Perhaps similar to the Times’s first online adventure in the late 1970s?

The article includes a quote from a community journalism company too:

“We now know that a brand tethered to social media for its growth and audience alone is not sustainable.”

Perhaps like the desire for more money than the Times’s LexisNexis deal provided? Perhaps?

Is Vice that special? I think the story is a footnote to the Gray Lady’s own adventures in the digital realm?

Isn’t that special too?

Stephen E Arnold, May 15, 2023

Good Enough AI: Decimating Bit-Blasted Wretches

May 9, 2023

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

I think the writers’ strike will make it possible for certain Hollywood producer types to cozy up with smart software. What works in the cinema wasteland are sequels and remakes of what has sold. My hunch is that purpose-built smart software will be able to output good enough scripts quickly. A few humanoids, maybe even on set actors, can add touches which elevate good enough to pretty good.

There are other humanoid writers now at risk from good-enough outputs. At a Derby Party on May 6, 2023, I whipped out my mobile and illustrated how You.com can crank out a short essay good enough to get an A or a B in a sophomore English class. One person who made a bundle of money selling automobiles said immediately, “I could have used this instead of that PR company and the part-timers who used to drive me crazy with questions.”

This person understood, and he was in his late 70s but still able to remember PR and marketing experts who were supposed to write presentations, ads, and marketing letters.

If a biz whiz heading to the old-age home grasp the concept, imagine what a rotund, confident MBA will do with good enough smart software.

What’s interesting to me is that the Washington Post, under the control of the original bulldozer driver Jeff Bezos, seems to understand what’s going to happen to many scribes, columnists, littérateurs, and scribblers. The ink stained wretches are going to become bit-blasted wretches. “He Wrote a Book on a Rare Subject. Then a ChatGPT Replica Appeared on Amazon” includes a quote from a human involved in smart software created content:

“We published a celebrity profile a month. Now we can do 10,000 a month.”

Net net: Smart software will create many opportunities for “writers” to find their future elsewhere. Fixer uppers of machine generated content may become a hot new gig along with TikTok maker of van life videos, creators of text based wall graffiti, and signs with messages such as “Will edit for food.”

Stephen E Arnold, May 9, 2023

Once High-Flying Publication Identifies a Grim Future for Writers… and Itself

May 8, 2023

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

Note: This essay is the work of a real and still-alive dinobaby. No smart software involved, just a dumb humanoid.

I am not sure what a Hollywood or New York writer does. I do know that quite a few of these professionals are on strike. The signs are not as catchy as the ones protesters in Paris are using. But France is known for design, and Hollywood and New York is more into the conniving approach to creativity in my opinion.

The article “GPT-4 Can’t Replace Striking TV Writers, But Studios Are Going to Try” identifies a problem for writers. The issue is not the the real or perceived abuses of big studios. The key point of the write up is that software, never the core competency for most big entertainment executives, is now a way to disintermediate and decimate human writers.

ChatGPT apps — despite their flaws — are good enough. When creativity means recycling previous ideas, ChatGPT has some advantages; for example, no vacays, no nasty habits, and no agents. Writers have to be renewed which means meetings. Software is licensed which another piece of smart software can process.

In short, writers lose. Even if the ChatGPT produced “content” is not as good as a stellar film like Heaven’s Gate, that’s show business. Disintermediation has arrived. Protests and signs may not be as effective as some believe. Software may be good enough, not great. But it is works fast, cheap, and without annoying human sign carrying protests.

Stephen E Arnold, May 8, 2023