Post Pandemic Blues: Tablets and Chromebooks Struggle

November 17, 2022

Might smartphones make some devices irrelevant? We learn from The Register that “Tablet, Chromebook Shipments Come Crashing Down.” The article examines IDC’s report of third-quarter shipments. It states a mere 38.6 million tablets were shipped between July 01 and September 30, a decline of almost 9% since the previous year. Only Huawei grew its sales as demand escalated in China and Russia, where sanctions barred the way for Western tech. Writer Paul Kunert reports:

“Apple saw sales decline 1.1 percent to 14.5 million, according to IDC estimates. Samsung was down 4 percent to 7.1 million, Amazon fell 8.1 percent to 4.3 million, Lenovo shipments dropped 36.6 percent to 2.7 million, and Huawei grew 2 percent to 2.4 million. In its results filed late last week, Apple said iPad sales to end users were up 21 percent to $8.3 billion in Q4 of its fiscal ’22 ended 30 September despite supply constraints. IDC tracks sales into the channel, hence the difference in the figures. Chromebook shipments fell at a far faster rate, down 34.4 percent year-on-year to 4.3 million devices. This was the fifth straight decline for this sector of the PC industry. The downward trajectory began in the US, which accounted for 70 percent of global shipments. … IDC placed Acer as market leader with shipments of 1 million, albeit down 23.8 percent on a year ago. Dell shrank 19.9 percent to 900,000 units, HP was down 26.8 percent to 800,000, Lenovo plunged 54.8 percent to 700,000, and Samsung was down 37 percent to 300,000.”

Researchers point out Chromebook sales spiked during the pandemic as students connected from home, so its decline is simply a return to normal levels. As for the rest, a tough economy was likely at play. Apparently one can endure a slightly smaller small screen when fuel and groceries are difficult to afford.

Cynthia Murrell, November 17, 2022

Math: Who Needs It to be a CEO? Answer: Maybe FTX?

November 16, 2022

Let me be clear. I don’t think much about crypto. One outfit pitched me to invest in a way for lawyers to transfer a deceased client’s digital currency to the heirs. Nope. Don’t care. Another eager young MBA wanted me to get involved in a deal offering investors shares in virtual cows. Nope. Really didn’t care.

Nevertheless, I find the ups and downs, ins and outs of the crypto world interesting. I enjoy learning how specialist firms deanonymize crypto transactions. The idea of putting a bad actor in front of a judge makes me happy. However, listening to a crime analyst suggest that more than 50 percent of digital currency transactions are related to illegal activities makes me some what sad.

I absorbed the information in “‘The Bottom Has Dropped Out’: Study Confirms Fears of Growing Learning Gaps.” Let’s assume the data in the article are close enough horseshoes, which is the modus operadi today I believe. The write up says:

In the earliest weeks of the pandemic, researchers associated with NWEA made two jaw-dropping predictions. The first — that school closures would lead to lower math and reading scores — has been borne out over and over since then. The second — that the already broad range of academic levels within classrooms would yawn wider — has now been confirmed.

The article grinds through data which make one thing clear: Quite a few students cannot do math particularly well.

I found this statement in the estimable publication The Daily Mail’s article “Harry Potter Fan Ex girlfriend 28 of Founder Sam Bankman-Fried Bragged She Only Needed Elementary School Math to Be CEO of His Start Up, Despite Being Propped Up by Funds from His Failed Sister Crypto Exchange” fascinating:

The write up states:

Ellison [the alleged friend of FTX’s founder] disliked common trading safeguards such as stop-loss orders, a way of capping losses and reducing risk.

Yep, grade school math. I think that going forward more exciting things will surface. Oh, one plus one equals two, not one plus one equals a Mississippi River flow of money. A magic wand is real too. Wave it an a million people will be really happy.

Stephen E Arnold, November 16, 2022

What Goes Up Must Come Down Even in Zuckland

November 15, 2022

Facebook used to be the indomitable ruler of social media, then its popularity plummeted in the face of older users and other platforms. Zuckerberg is facing a similar decline with his Meta company, but the plunge hits his deep pockets. Techspot explains what is going on with Zuckerberg and Meta in the article, “Meta Value Down $520 Billion Last Year, Threatening Its Position As a Top 20 Company.”

Meta has less net profits because of the economic downturn in the United States. Companies are spending less money are advertisements through Meta’s products. Meta’s investors are also worried, because the company is funneling billions into the VR/MR “metaverse” project. Meta’s VR/MR branch is called Reality Labs and it lost $10.2 billion in 2021. Reality Labs’s losses are expected to increase in 2023. In 2022, the losses are expected to be $85-87 billion.

Facebook hit the $1 trillion market cap in June 2021 more quickly than any company before. At the beginning of 2022, Facebook was the sixth biggest company in the US. Since Zuckerberg, however, renamed his company Meta its worth has fallen and it could secure the twentieth spot in the biggest company list.

Zuckerberg continues to push VR agenda:

“Despite losing billions and an analyst’s prediction that many business projects in this area will close by 2025, Zuckerberg is doubling down on the metaverse. ‘Look, I get that a lot of people might disagree with this investment, but from what I can tell, I think this is going to be a very important thing,’ he said. ‘People will look back a decade from now and talk about the importance of the work being done here.’”

Zuckerberg was a visionary with Facebook. Is he replicating his visions with the metaverse? He is losing billions of dollars, but it could pay off or it will be another blunder in technology history.

Whitney Grace, November 15, 2022

A Digital Tweet with More Power Than a Status-6 Torpedo

November 14, 2022

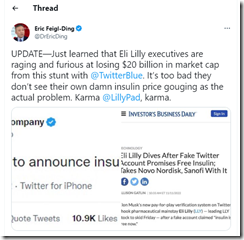

I have no idea if the information captured in this screenshot of a Tweet on the Elon thing is correct. Figure it out seems to be the optimal way to deal with fake information.

My hunch is that the text is tough to read. In a nutshell, a “stunt” tweet knocked $20 billion off the market cap of the ethical and estimable firm Eli Lilly.

The item I spotted was attributed to an entity identified as Erik Feigl Ding [blue check]. I am not sure what a blue check means.

One of my Arnold Laws of Online says, “Information has impact.” My thought is that $20 billion, the alleged lawsuit, and the power of a digital message seems obvious.

Does this suggest that the dinobaby approach to curated information within an editorial structure is a useful business process? Elon, what’s your take?

Stephen E Arnold, November 14, 2022

Just A Misunderstanding: This Is Not a Zuck Up

November 4, 2022

I read “Since Becoming Meta, Facebook’s Parent Company Has Lost US$650 Billion.” The article presents some information about how the Meta zuck up has progressed. Let me highlight three items, and I urge you to check out the source document for more data points.

- “more than half a trillion dollars in value lost in 2022”

- “From the start of 2022 to now, the company has shed 70 per cent of its value” (Now means October 28, 2022 I think)

- “Apple’s changes cost Meta around $10 billion in ad revenue.”

I would mention that there are some on going legal probes into the exemplar of the individual who has his hands on the steering wheel of what looks to me like a LADA Kalinka. I mean what better vehicle for dating at Harvard a few years ago?

I think that the Top Thumbs Upper at Meta (aka Facebook) has a vision. Without meaningful regulation from assorted governmental agencies, the prospect of a broken down Kalinka is either what one deserves for selecting the vehicle or a menace to others on the information highway.

I understand there is a parking space next to the MySpace 2003 Skoda Fabia.

Stephen E Arnold, November 4, 2022

Meet TOBOR: The CFO Which Never Stops Calculating Your Value

November 3, 2022

Robot coworkers make us uncomfortable, apparently. Who knew? ScienceDaily reports, “Robots in Workplace Contribute to Burnout, Job Insecurity.” The good news, we are told, is that simple self-affirmation exercises can help humans get past such fears. The write-up cites research from the American Psychological Association, stating:

“Working with industrial robots was linked to greater reports of burnout and workplace incivility in an experiment with 118 engineers employed by an Indian auto manufacturing company. An online experiment with 400 participants found that self-affirmation exercises, where people are encouraged to think positively about themselves and their uniquely human characteristics, may help lessen workplace robot fears. Participants wrote about characteristics or values that were important to them, such as friends and family, a sense of humor or athletics. ‘Most people are overestimating the capabilities of robots and underestimating their own capabilities,’ [lead researcher Kai Chi] Yam said.”

Yam suspects ominous media coverage about robots replacing workers is at least partially to blame for the concern. Yeah, that tracks. The write-up continues:

“Fears about job insecurity from robots are common. The researchers analyzed data about the prevalence of robots in 185 U.S. metropolitan areas along with the overall use of popular job recruiting sites in those areas (LinkedIn, Indeed, etc.). Areas with the most prevalent rates of robots also had the highest rates of job recruiting site searches, even though unemployment rates weren’t higher in those areas.”

Researchers suggest this difference may be because workers in those areas are afraid of being replaced by robots at any moment, though they allow other factors could be at play. So just remember—if you become anxious a robot is after your job, just remind yourself what a capable little human you are. Technology is our friend, even if it makes us a bit nervous.

Cynthia Murrell, November 3, 2022

Adobe-Pantone, Has an Innovator Covered You You with Freetone Brown?

October 31, 2022

Annoyed about the loss of Pantone colors in Adobe products? I am okay with Affinity and assorted open source tools, so what the innovation free outfits do is not of consequence to me.

Should you want an open source alternative, a color wizard named Stuart Semple has a solution. The details of the colors or “frequencies” as I think of them appear in “I’ve Libertated [sic] the Pantone Colour Palette and I’m Giving It Away for Free Unless You Work for Adobe.”

The colors can be downloaded at this link. If the link goes dead, navigate to Culture Hustle and hunt around for the download link. Even though the palette is free, you will be coughing up your email address and some other potentially interesting information.

Several observations:

- The cloud monetization plays are likely to stimulate some innovation. The vector of new angles will be designed to block, undercut, undermine, or discredit the corporate cleverness

- As options become available, increased friction in work processes will result. File formats, digital fingerprints, and embedded sequences similar to those used in steganography will derail some activities. Getting back on track will consume time and resources

- User groups are dangerous constructs. In person groups are less volatile than online communities. Clever corporates may find themselves locked in an unpleasant and litigious social dust up.

Check out those Freetone browns. What does the color suggest?

Stephen E Arnold, October 31, 2022

What Is the Color of Greed or Will a Color Picker Land You in Court?

October 31, 2022

When I arrived in Washington, DC, for my first real job at a nuclear consulting company loved by Richard Cheney, I found myself responsible for a contractor on K Street. At that meeting, the contractor explained that the Cheney fave used a specific color of blue to indicate nuclear radiation. Do you have a color in mind for Cherenkov radiation. I do. The printed color came from a thick and somewhat weird collection of color samples bound with a rivet through the heavy pages. Each page contained a group of colors; for example, PMS 313. I said, “Okay, with me.” (The P represents Pantone; the numbers are the presumably proprietary colors once happily confided to the dead tree printing world.)

On my Mac I have an application called ColorSlurp. No printed collection of color chips needed. Just look at a picture in Yandex images for Cherenkov radiation and click on a color. I can then use that color in a painting application like the estimable Paint.net software.

The color technology seems like magic to me. I can, for example, create a pdf of the goose which I use for my logo tinted a wonderful mélange of dead leaf brown and feather gray. Am I in legal jeopardy?

I just read “ You’re Going to Have To Pay to Use Some Fancy Colors In Photoshop Now.” The article explains much about color intellectual property and nothing about frequency. However, I noted this statement:

widely used Adobe apps like Photoshop, Illustrator, and InDesign will no longer support Pantone-owned colors for free, and those wishing for those colors to appear in their saved files will need to pay for a separate license. And this is real life.

Okay, a subscription to a frequency. I assume this makes sense to CPAs, MBAs, and the Adobe/Pantone crowd.

The point is that cloud services make it easy to monetize that which was more difficult to monetize in Gutenberg’s day.

I think we have discovered a color for greed. That color is linked to the color of attorneys and legal eagle feathers. I don’t want to name a color, present a P number, or include its frequency.

Let’s think about “real life.” Pleasant, isn’t it. What color of brown are the walls in most courtrooms tinted? There must be a PMS number for that. I think it is a combo of fertile loam and Cherenkov radiation. If you see it, it is too late.

Stephen E Arnold, October 31, 2022

Google: Clever Cost Cutting

October 18, 2022

Most web searchers do not make it past the first page or two of Google results. But even if one has the patience to go all the way to the end, it seems one can only see a fraction of the results promised at the top of each page. According to a blog post from web scraper SerpApi, “Google’s ‘Millions of Search Results’ Are Not Being Served in the Later Pages Search Results.” Writer Justin O’Hara reports:

“A misconception regarding Google’s search results is that all of the results are being served to the user conducting that particular search. Those 2 billion search results can’t be gotten through Google’s pagination, and it seems that this number is somewhat arbitrary to the search, or commonality of the keyword. I rarely go past the 2nd or 3rd page of Google’s search results for any kind of query anymore, but these rankings of results are big business with Search Engine Optimization. I wanted to do a little case study on the actual amount of searches that get served to users for a couple different searches.”

O’Hara experimented by searching for his company’s name and could see only 146 results out of the 166,000 Google said it found. Repeating the search with omitted results included, as Google offers, garnered only 369 results. But why? Cost cutting? Or perhaps information shaping? We may never know. Not surprisingly, O’Hara emphasizes SerpApi’s Google Search API can scrape the results Google itself does not deign to pass on to users.

Cynthia Murrell, October 18, 2022

Internet Archive: Maybe a Goner?

October 14, 2022

We conceptualize the Internet is an unobstructed entity. The Internet relies on a high-tech, interconnected network of servers and wires that requires an unknown amount of energy. If there are any power outages or the servers breaks, then the Internet is gone. Unfortunately, it could mean the Internet Archive, an online archive of digital media, could disappear due to a lawsuit brought on by authors and publishers.

Slate explains why authors and publishers are upset with the Internet Archive in: “Could The Internet Archive Go Out Like Napster?” In March 2020, the Internet Archive allowed users to check out more than one item from its scanned book collection due to the COVID-19 pandemic. The event was called the National Emergency Library, but publishers and authors claimed this was piracy and harmed their profits. Lawsuits were filed and the National Emergency Library was shut down. The lawsuits are still ongoing, but authors, librarians, and other organizations are worried the Internet Archive could disappear:

“One thing hasn’t changed: fears that the vagaries of this case could cripple the archive and, subsequently, the myriad services it offers the 1.5 million people who visit it every day. In addition to lending books digitally, the Internet Archive hosts the Wayback Machine, a tool that has chronicled internet history since 1996; the concern is that if legal costs drain the archive of its funds, all of its services could be affected. Users of the site and digital archivists have compared the potential loss of the archive’s services to the burning of the Library of Alexandria. Yet book companies also view the stakes here as existential for their business model; the International Publishers Association stated that this case is of “global significance” to its members.”

If the problem was only about the National Emergency Library, then the lawsuits would be over. The bigger picture surrounds how publishers want to block controlled digital lending. There are many ways libraries allow users to check out digital media, popular methods include securing licenses through an app like Libby. Publishers and some authors want to block controlled digital lending, because they only make profits from the first purchase. The use of ebook loans, however, allows them to charge per read. Librarians love controlled digital lending, because it would save them money.

The Internet Archive uses controlled digital ending and states its book collection falls under fair use. The Internet Archive allows users access to a multitude of books that are in copyright limbo: they are out of print, no one knows who owns the copyright, or physical copies are scarce.

Publishers could work with the Internet Archive, but profits always win over the decency of keeping a non-profit (that actually does something good) up and going. So much for the free, digital utopia, the Internet was supposed to be.

Whitney Grace, MLS, October 14, 2022