A Reminder: AI Winning Is Skewed to the Big Outfits

February 8, 2024

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

I have been commenting about the perception some companies have that AI start ups focusing on search will eventually reduce Google’s dominance. I understand the desire to see an underdog or a coalition of underdogs overcome a formidable opponent. Hollywood loves the unknown team which wins the championship. Movie goers root for an unlikely boxing unknown to win the famous champion’s belt. These wins do occur in real life. Some Googlers favorite sporting event is the NCAA tournament. That made-for-TV series features what are called Cinderella teams. (Will Walt Disney Co. sue if the subtitles for a game employees the the word “Cinderella”? Sure, why not?)

I believe that for the next 24 to 36 months, Google will not lose its grip on search, its services, or online advertising. I admit that once one noses into 2028, more disruption will further destabilize Google. But for now, the Google is not going to be derailed unless an exogenous event ruins Googzilla’s habitat.

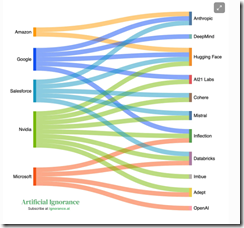

I want to direct attention to the essay “AI’s Massive Cash Needs Are Big Tech’s Chance to Own the Future.” The write up contains useful information about selected players in the artificial intelligence Monopoly game. I want to focus on one “worm” chart included in the essay:

Several things struck me:

- The major players are familiar; that is, Amazon, Google, Microsoft, Nvidia, and Salesforce. Notably absent are IBM, Meta, Chinese firms, Western European companies other than Mistral, and smaller outfits funded by venture capitalists relying on “open source AI solutions.”

- The five major companies in the chart are betting money on different roulette wheel numbers. VCs use the same logic by investing in a portfolio of opportunities and then pray to the MBA gods that one of these puppies pays off.

- The cross investments ensure that information leaks from the different color “worms” into the hills controlled by the big outfits. I am not using the collusion word or the intelligence word. I am just mentioned that information has a tendency to leak.

- Plumbing and associated infrastructure costs suggest that start ups may buy cloud services from the big outfits. Log files can be fascinating sources of information to the service providers engineers too.

My point is that smaller outfits are unlikely to be able to dislodge the big firms on the right side of the “worm” graph. The big outfits can, however, easily invest in, acquire, or learn from the smaller outfits listed on the left side of the graph.

Does a clever AI-infused search start up have a chance to become a big time player. Sure, but I think it is more likely that once a smaller firm demonstrates some progress in a niche like Web search, a big outfit with cash will invest, duplicate, or acquire the feisty newcomer.

That’s why I am not counting out the Google to fall over dead in the next three years. I know my viewpoint is not one shared by some Web search outfits. That’s okay. Dinobabies often have different points of view.

Stephen E Arnold, February 8, 2024